If you happened to see the cover of the July 4, 2016 cover of Time Magazine, you would have noticed that the cover article was about CRISPR. If you have never heard of CRISPR, I suggest that you keep your eyes open for future features about CRISPR in the media. (Will we see a feature about CRISPR on 60 Minutes?)

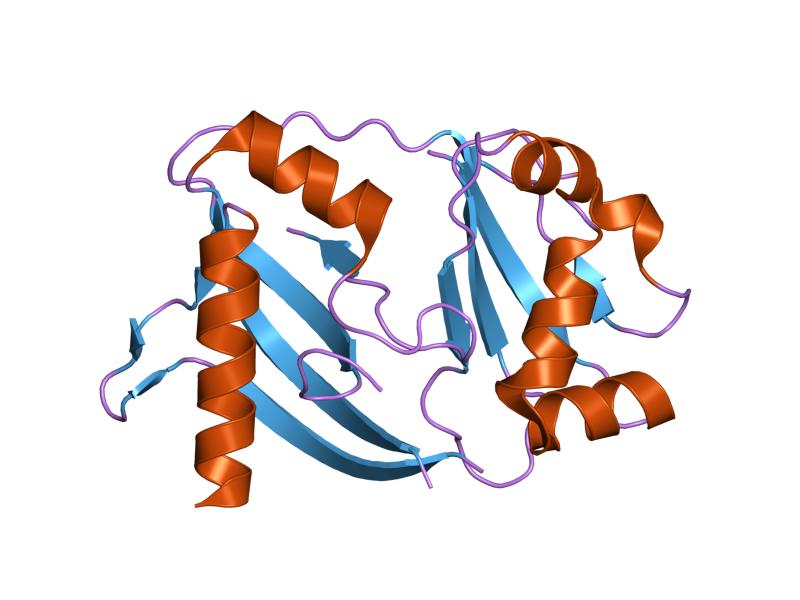

So what is CRISPR? CRISPR stands for “clustered regularly interspaced short palindromic repeats”. Before you eyes glaze over and you skip the rest of this article, let me tell you what it means in very simple terms. It is a technique for editing and splicing DNA much more quickly, simply, and less expensively than previously done in the past. This is a revolutionary technique that could lead to the potential to cure any genetic disease.

According to the free list of CRISPR stocks here at WallStreetNewsNetwork.com, there are several publicly traded companies that have jumped on the CRISPR bandwagon, both big and small. Obviously, the CRISPR technology industry is at its very early stages, so there are risks involved with some of the purer plays, none of which are currently generating earnings.

Editas Medicine (EDIT) is a Cambridge, Massachusetts based genome editing company, focusing on treating patients with genetically defined diseases through the development of a proprietary genome editing platform based on CRISPR/Cas9 technology. The company, which sports a market cap of a bit over $800 million, has $229 million in cash, which works out to about $6.51 in cash per share. It carries a debt load of $11.65 million.

Intellia Therapeutics (NTLA) is another pure play CRISPR stock, and is currently collaborating with Novartis (NVS). Intellia is developing in vivo projects which target liver diseases, including transthyretin amyloidosis, alpha-1 antitrypsin deficiency, hepatitis B virus, and inborn errors of metabolism; and ex vivo relating to chimeric antigen receptor T cell and hematopoietic stem cell product candidates. The stock has a market cap of $700 million, cash of $64 million, and is debt free.

Cocrystal Pharma (COCP) is the most speculative of the group, carrying a market cap of $314 million. This debt free company has over $10 million in cash. Cocrystal is working on CRISPR/Cas9 technologies for developing cures for hepatitis B virus and the human papilloma virus.

CRISP is a narrow field in the biotechnology arena, but it may become the fastest growing and most significant of all the biotech industries. To see a list of over a dozen CRISPR companies, go to WallStreetNewsNetwork.com link here.

Disclosure: Author owns COCP.

By Stockerblog.com

I think this is a great area to invest in. However, I think all the pure play stocks are very long term investments, so an investor has to wait a very long time.

I agree. You will have to wait it out until these stocks turn a profit.

This post is Great , I’ve bookmarked it and shared on facebook. Thanks A lot

I’m glad you enjoyed the post. Stay tuned for more.

I just passed by ur blog & love reading it! Especially all these recent posts I’ve also read the previous ones.

Have you heard about the Punch TV Studios IPO. You really need to look into it.