by Fred Fuld III

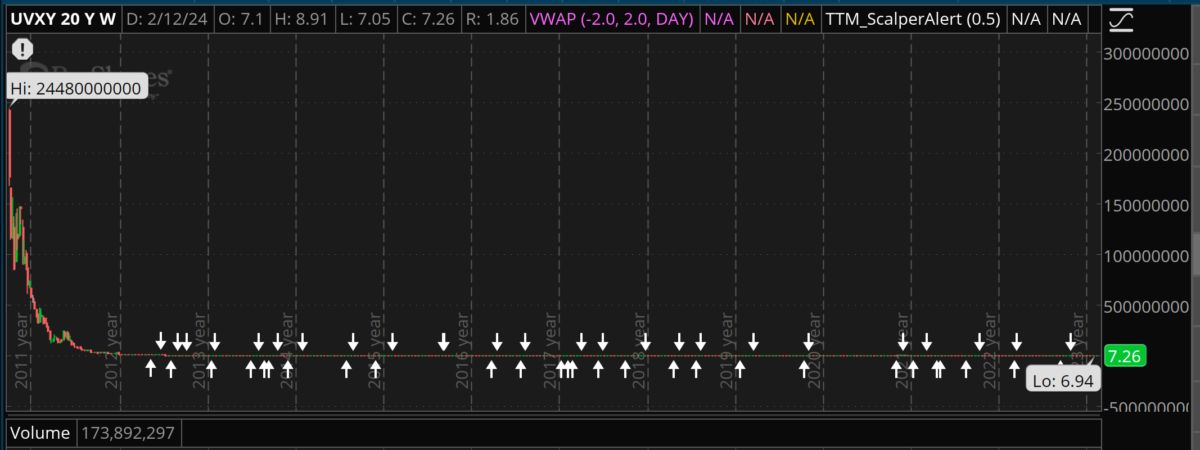

Yes, you read that right. There was a stock that traded at $24,480,000,000 per share on a split adjusted basis back on October 3, 2011. That’s $24.48 billion!!!

Today, the stock is trading at $7.25 per share.

The company has had numerous reverse splits, which account for its very high historical price.

Not too bad a trade if you were short it.

Actually it is technically an exchange traded fund, more commonly called an ETF.

This ETF is the ProShares Ultra VIX Short-Term Futures ETF (UVXY), has a goal of producing one and one-half times (1.5x) the daily performance of the S&P 500 VIX Short-Term Futures Index.

The problem with investing in these kinds of ETFs are the risks that are involved, which can affect the price adversely if held for long periods of time. These risks include:

High Volatility: UVXY aims to deliver 1.5 times the daily performance of the S&P 500 VIX Short-Term Futures Index, which tracks the implied volatility of the S&P 500. Volatility is inherently unpredictable, and even small movements in the VIX can lead to large swings in UVXY’s price. This means you could lose a significant portion of your investment very quickly.

Leverage: UVXY uses leverage to achieve its 1.5x target. This means it uses borrowed money to amplify returns, which magnifies both gains and losses. While leverage can lead to larger profits in rising markets, it can also lead to much steeper losses in declining markets.

Decay over Time: Unlike traditional assets that tend to appreciate over time, VIX futures tend to revert to their long-term average. This means holding UVXY for extended periods, even in volatile markets, could lead to significant losses due to this “backwardation” effect.

Rolling Costs: VIX futures contracts expire monthly, and UVXY needs to continuously roll these contracts into new ones. This rolling process incurs costs, which can eat into returns over time, especially during periods of low volatility.

Liquidity: While UVXY is an exchange-traded fund, its underlying futures contracts may have lower liquidity than stocks. This could make it difficult to enter or exit positions quickly, especially during volatile periods.

Expenses: UVXY has an expense ratio of 0.95%, which means it charges 0.95% of your assets annually for management fees. These fees can further erode your returns, especially over longer holding periods.

Not a Hedge: While some investors use UVXY as a hedge against market downturns, it’s crucial to understand that it’s not a perfect hedge. Its performance can be uncorrelated to market movements, and it may not effectively protect your portfolio during all market conditions.

These are extremely speculative ETFs which are appropriate for experienced traders only.

Thanks to Slope Of Hope for giving me the heads up about this.

Disclosure: Author’s no position in the above ETF.