by Fred Fuld III

When I started looking into silver as an investments a few years ago, not only did I look at silver mining stocks and iShares Silver Trust ETF (SLV), I also started buying silver coins.

I was aware of the counterfeit coins that were floating around, primarily the silver rounds and the uncirculated silver dollars. Because of that, I considered buying slabbed coins (the ones that are graded and encapsulated in plastic), but they are pretty expensive and sell for much more than the silver content, so I went for the low quality silver coins, figuring no one would bother counterfeiting those.

I was wrong.

You can buy coins on such sites as eBay (EBAY), Etsy (ETSY), Amazon (AMZN), Facebook (META), Whatnot, Craigslist, and many other eCommerce sites. Certain sellers on some of these major selling sites are offering cull coins below silver melt prices. These aren’t auction start prices, these are actual “for sale” prices.

Let me explain what a cull coin is. A “cull coin” refers to any coin that is considered to be in poor condition or has flaws, making it undesirable for collectors, but potentially attractive for investors seeking, in this case, silver content. The cull coin may have a hole, may be cleaned (remember, never clean an old coin – it will reduce the value substantially), may be bent, or may be heavily scratched.

But let’s get back to prices. Why would someone sell a coin for five or ten dollars less than competitors? Why would they sell for less than the value of the silver content? Why? Because they are fake.

What I can’t understand is why are the counterfeiters making fakes of cheap coins? I can understand making fake uncirculated coins because of the higher value, but low quality junk? It’s hard to believe, but I guess if there is a market for something, someone will create a fake.

In order to avoid getting stuck with any of these fakes, here’s what you need to check:

• Is the coin selling for far less than similar coins?

• Does the seller have very little feedback?

• Does the seller have significant negative feedback?

• Did the seller recently create an account?

• Does the seller copy pictures from other sellers?

If any of the above are true, be careful.

The best thing to do is to buy from sellers who have been selling for years and have excellent feedback.

Silver Coins and Authenticity

Be careful about buying silver coins, as there are many fakes being distributed. These are not just the coins with numismatic value but also the so-called junk silver coins and even the bullion coins (silver rounds).

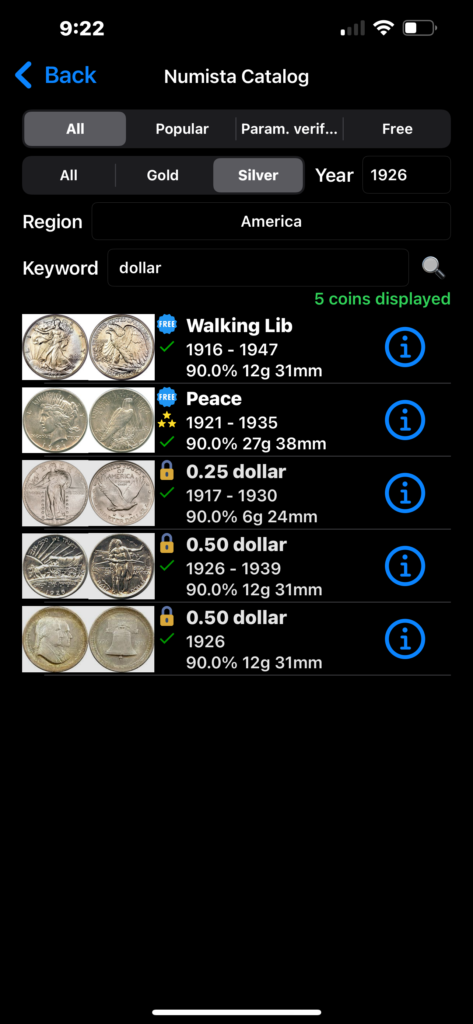

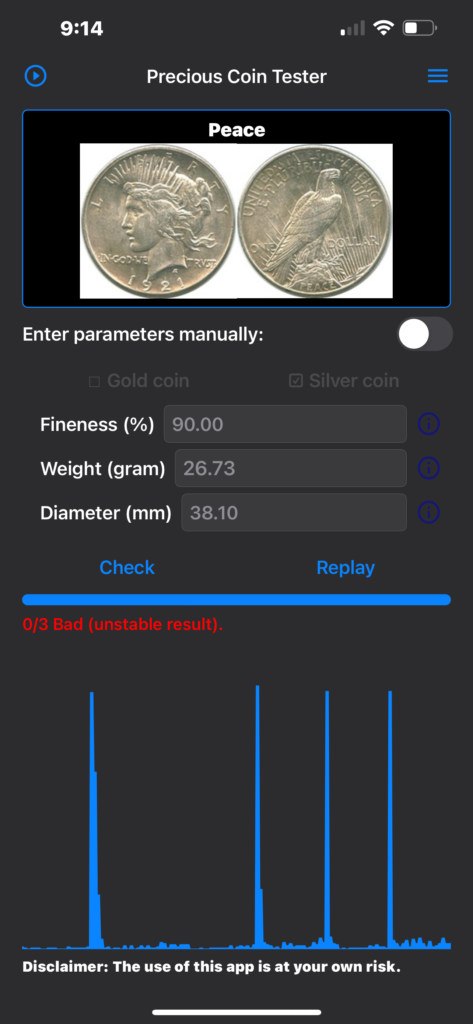

Fortunately, there are several ways of checking whether a coin is genuine or not. One simple way is to use a phone app called CoinTester. It measures the sound of the ping when the coin is hit with an object, like a pencil.

First, you choose the type of coin. (Note: If you are checking a silver dollar, for Keyword, just type Dollar, not Silver Dollar.) You place the coin on your fingertip, tap the word Check on the app, then hit the coin a few times with something that won’t damage the coin (I use the wooden part of a pencil.) If is shows a 0 or 1 out of 3, it means the coin is a fake. If it shows a 2 or a 3 out of three, the coin is real.

Just remember that all tests for coins aren’t foolproof. The best approach is to buy from a very reputable coin dealer.

Many numismatic coins are slabbed. In numismatics (the study or collection of coins), “slabbed” refers to the process of encapsulating a coin in a hard plastic holder, often called a slab. These slabs are usually sealed and graded by a professional coin grading service. The purpose of slabbing coins is to protect them from damage and to provide an objective assessment of their condition and authenticity.

When a coin is slabbed, it is typically accompanied by a label indicating its grade, which is determined based on factors such as wear, luster, strike quality, and any imperfections. This grading process helps collectors and investors assess the value of the coin and provides assurance about its authenticity and condition.

Slabbed coins are often considered more desirable for collectors and investors because they come with a trusted third-party evaluation, reducing the risk of buying counterfeit or over-graded coins.

So if you decide to add silver coins to your investment portfolio, buy with caution.

Disclosure: Author owns EBAY, AMZN, and has a long option position in SLV.