by Fred Fuld III

The Beneish M-Score is a financial metric designed to identify the likelihood that a company has engaged in earnings manipulation. Developed by Professor Messod Beneish of Indiana University, the M-Score uses a combination of financial ratios and variables to flag irregularities in accounting practices. Since its introduction in the late 1990s, it has become a critical tool for auditors, investors, and analysts who aim to evaluate the authenticity of a company’s financial reporting.

At its core, the Beneish M-Score combines eight variables, derived from publicly available financial statements, to create a composite score. These variables include metrics like the Days Sales in Receivables Index (DSRI), which measures changes in the relationship between receivables and sales, and the Gross Margin Index (GMI), which compares a company’s gross margin over time. Others, like the Asset Quality Index (AQI) and the Total Accruals to Total Assets Ratio (TATA), further analyze a firm’s asset structure and discretionary accounting practices.

The calculation results in a score that typically falls into one of two categories: firms with an M-Score less than -2.22 are considered less likely to manipulate earnings, while those with an M-Score higher than this threshold warrant further scrutiny.

I want to make sure you understand completely how this score works. It is always calculated as a negative number. The lower the negative number, the less likely the accounting is being manipulated. The higher the number, in other words, the smaller the negative number, the chances are greater that manipulation is involved.

A rule of thumb is that if the M-Score is -2.00 or lower, a greater NEGATIVE number, such as -2.50 or -3.00, the company is not a manipulator. If the score falls into the range of -2.00 to -1.78, the company is a possible manipulator. If the score is -1.78 to zero, it is a likely manipulator.

Although the M-Score does not definitively prove manipulation, it raises red flags, signaling that a company’s financial activities may require deeper investigation.

One of the most famous cases illustrating the power of the Beneish M-Score involved Enron. Retrospective analyses revealed that the M-Score flagged the company as a high-risk manipulator well before its infamous collapse. This case demonstrated the score’s potential as a forward-looking tool, though it also highlighted its reliance on accurate and consistent data from company filings.

Despite its utility, the Beneish M-Score has limitations. It is primarily designed for manufacturing or industrial firms and may be less effective in service-oriented or financial sectors, where the nature of financial reporting differs significantly. Furthermore, the M-Score is sensitive to accounting anomalies, which may not necessarily indicate deliberate manipulation but rather reflect differences in industry practices, acquisitions, or rapid growth.

For investors and analysts, the Beneish M-Score should be viewed as a starting point rather than a definitive verdict. It is most effective when used alongside other analytical tools and qualitative assessments. When combined with careful evaluation of a company’s leadership, industry trends, and broader financial metrics, the M-Score can serve as a valuable part of a due diligence process.

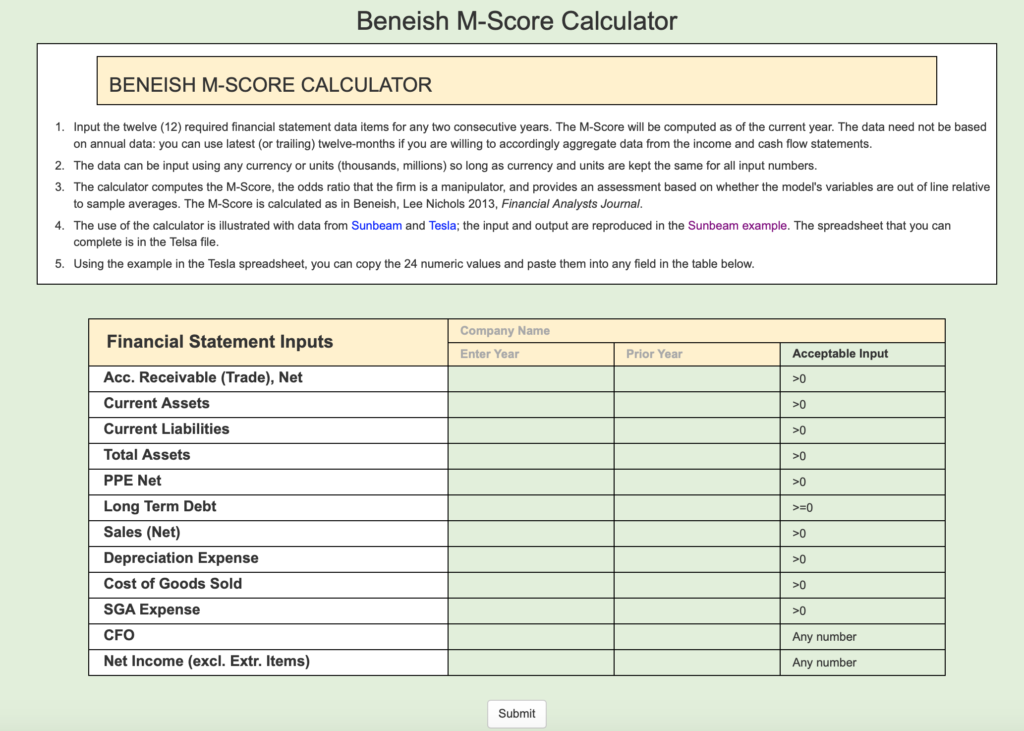

If you want to try the M-Score on a stock you are interested in, you can go to the M-Score Calculator, which is hosted by Indiana University, and try it on your own.

I tried it with a couple of stocks and this is what I came up with.

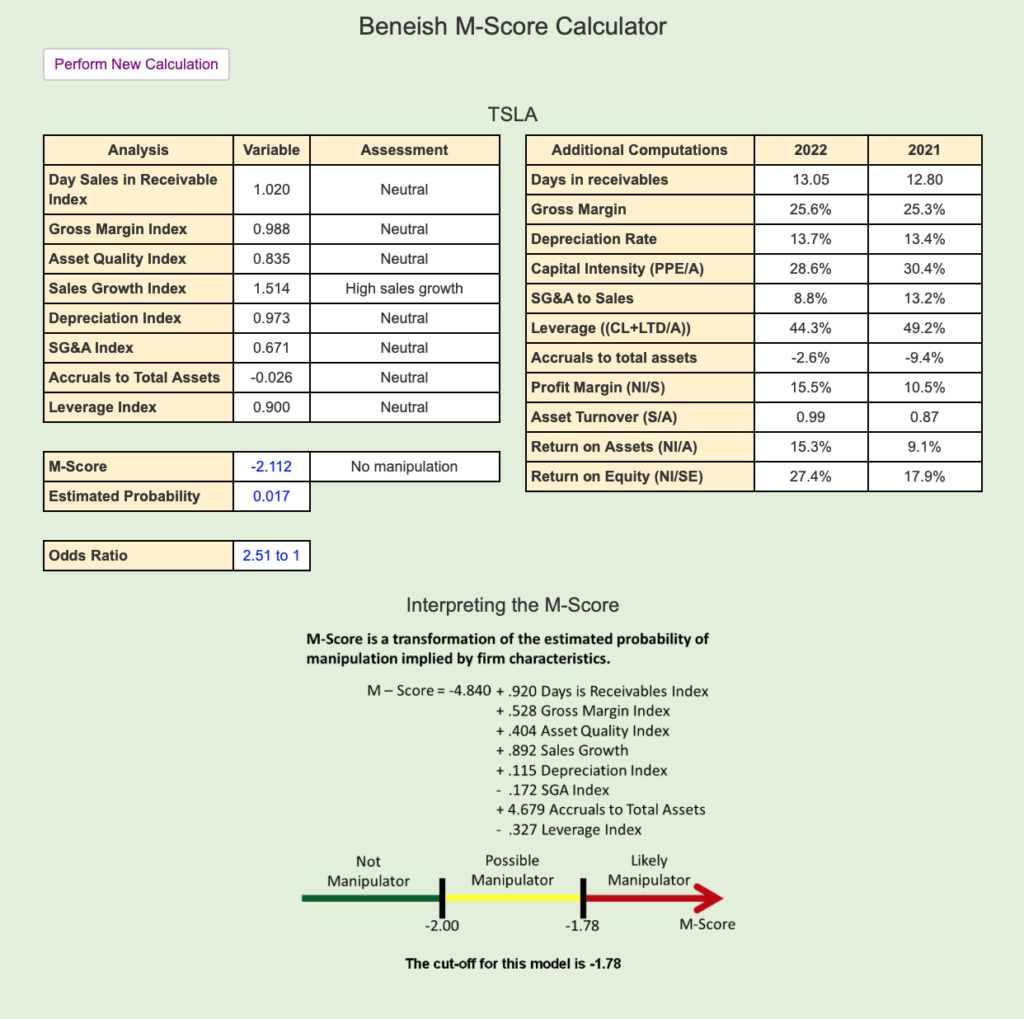

First, I started with Tesla (TSLA).

Tesla ended up with an M-Score of -2.112, a score of less than -2.00 (a greater negative number that -2.00), which means it falls in the green Not a Manipulator category.

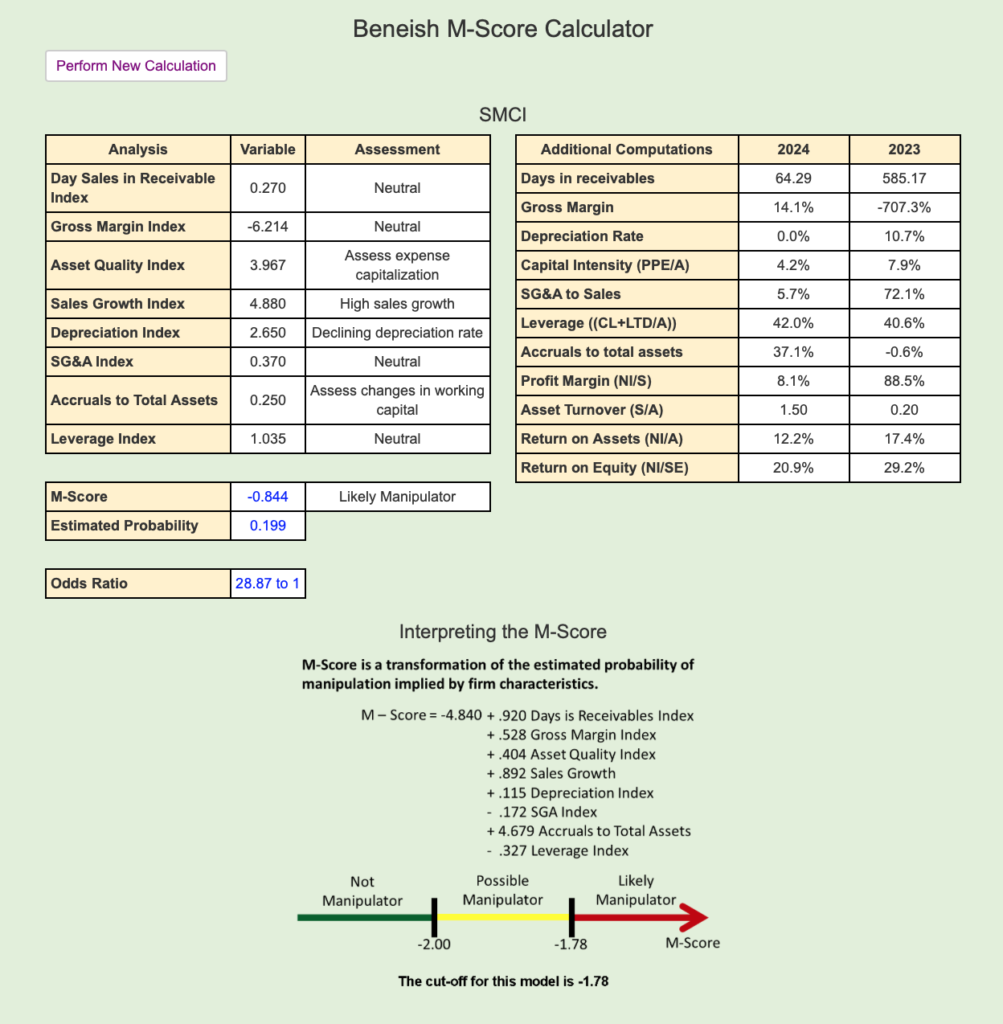

Then I tried Super Micro Computer (SMCI):

You have probably seen the news lately about SNCI.

- Accounting Firm Resignation: In October 2024, Ernst & Young resigned as Super Micro’s auditor, citing concerns about transparency and internal controls related to financial reporting.

- Delayed Annual Report: Super Micro delayed the filing of its annual report, leading to a significant drop in its stock price.

- Hindenburg Research Report: Hindenburg Research published a report alleging that Super Micro continued to engage in accounting manipulation, sibling self-dealing, and potential sanctions evasion.

These recent events have raised serious concerns about the accuracy and reliability of Super Micro’s financial reporting. Investors and analysts are closely monitoring the situation as the company works to address these issues and regain credibility.

So what did the M-Score Calculator show for Super Micro? It displayed an M-Score of -0.844, a higher number than -1.78 (lower negative number), based on the. This puts it well in the range of red Likely Manipulator.

In today’s complex financial landscape, where trust in corporate reporting is paramount, tools like the Beneish M-Score play a crucial role. By offering a quantitative approach to identifying irregularities, it empowers stakeholders to make informed decisions, promoting greater accountability in corporate governance.

Disclosure: Author owns a small amount of TSLA.