by Nkem Iregbulem

Many people drink coffee first thing in the morning. Some heavily rely on this dose of caffeine to boost their energy and start their day. Turns out that in addition to its energy-boosting powers, coffee may be associated with more health benefits than we once thought. Recent studies have highlighted different reasons why coffee may be good for us.

One news article reports on a recent study conducted to examine previously unidentified risk factors for certain heart conditions. Researchers at the University of Colorado medical school analyzed data from the Framingham Heart Study, which track the eating habits and cardiovascular health of over 15,000 individuals since the 1940s. They used machine learning to identify trends in this large data set. The study found that drinking coffee may lower one’s risk of heart failure, stroke, and coronary heart disease. The researchers used the same methods to analyze two other large study groups, the Cardiovascular Heart Study and the Atherosclerosis Risk in Communities Study, and found similar results.

An umbrella study published in the British Medical Journal in 2017 highlights a range of coffee’s potential health benefits. The study identified over 200 meta-analyses of observational and interventional studies that investigated the link between coffee and numerous different health outcomes. These health outcomes could come from any adult population in all countries and all settings. Researchers found that drinking three to four cups of coffee per day lowers one’s risk of all cause mortality, heart disease, several specific types of cancer, and neurological, metabolic, and liver conditions.

Another study, published in Circulation for the American Heart Association, presents positive findings. The study investigated the connection between the consumption of caffeinated and decaffeinated coffee and total and cause-specific mortality among men and women from the Nurses’ Health Study, the Nurses’ Health Study II, and the Health Professional Follow-up Study. Researchers found that the consumption of 1 to 5 cups of coffee a day may lower one’s risk of mortality. More specifically, they found that coffee consumption was associated with an 8% to 15% reduction in the risk of death.

You can even use coffee as a financial instrument. The price of the iPath® Series B Bloomberg Coffee Subindex Total Return ETN (BJO) has decreased by 1.16% since it began trading this past February. BJO consists of one futures contract on the commodity of coffee and allows investors to gain exposure to coffee prices without worrying about direct exposure to futures.

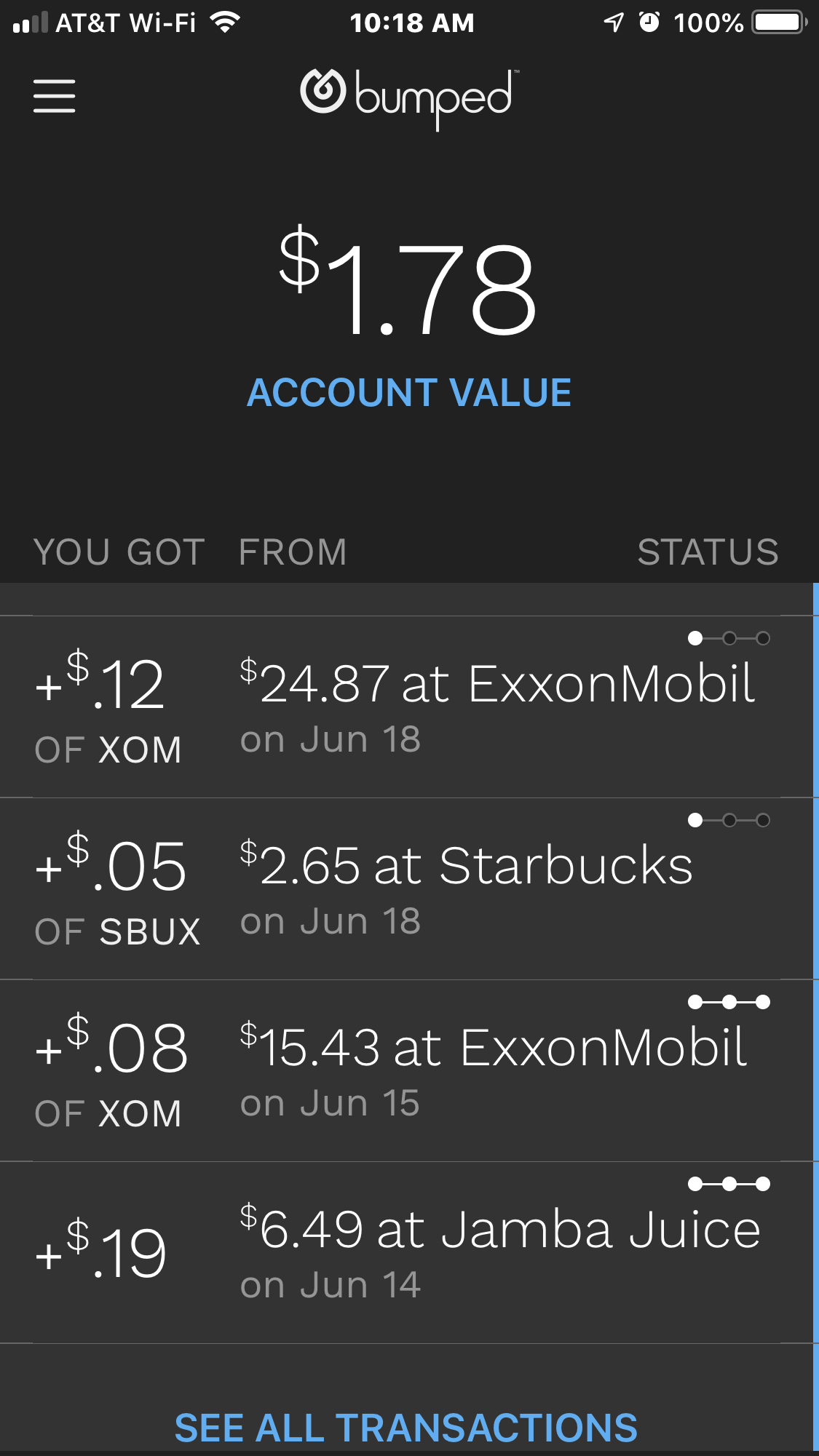

The potential health benefits may also compel you to invest in some coffee related companies. Your options include Starbucks (SBUX), Coffee Holding (JVA), Farmer Bros. Co. (FARM), Spot Coffee (Canada) Ltd. (SPP), and Youngevity International Inc. (YGYI). All of these stocks are traded on NASDAQ except SPP, which is traded on the TSX Venture Exchange — previously known as the Canadian Venture Exchange.

Most people have heard of Starbucks, a global coffee powerhouse. The company has over 28,000 stores around the world that sell coffee, tea, blended drinks, sandwiches, pastries, and many other food and drink items. As the largest coffeehouse chain in the world, Starbucks boasts a large market cap of $79.3 billion and pays a dividend yield of 2.01%, which has been up each year since 2010. The company has also increased its revenue each fiscal year since 2009 and enjoys a 5-year revenue growth rate of 11.01%. With a price-to-sales ratio of 3.51, the company’s stock is somewhat overpriced. Starbucks’ stock has a PE ratio of 25.13, a forward PE ratio of 22.88, and a high price-to-book ratio of 16.76.

You may also want to consider investing in Coffee Holding, a wholesale coffee roaster and dealer that manufactures, roasts, packages, markets, and distributes roasted and blended coffee for private labeled accounts and its own brands. Its products can be divided into three product categories: wholesale green coffee, branded coffee, and private label coffee. With small market cap of $24.24 million, the company’s stock is very speculative. Coffee Holding’s revenue has decreased each fiscal year since 2015 as the company faces a negative 5-year revenue growth rate of -14.98%. The stock has an excellent price-to-sales ratio of 0.31 though it trades at 47.25 times trailing earnings.

A third option is Farmer Brothers Company, a coffee foodservice company that manufactures, wholesales, and distributes coffee, tea, and hundreds of other foodservice items to retailers and foodservice providers. Its customers include hotels, offices, restaurants, convenience stores, and other establishments. The company has a market cap of $501.9 million. Its stock trades at 23.29 times trailing earnings and at 37.59 times forward earnings. It has a price-to-book ratio of 2.41 and a favorable price-to-sales ratio of 0.83. Though the company has a 5-year growth rate of 1.66%, the company has seen slowly decreasing revenue values each fiscal year since 2015.

Two other coffee-related companies to consider are Spot Coffee (Canada) Ltd. and Youngevity International. The former has a market cap of just $18.89 million, and the latter has a low market cap of $75.59 million, making both these stocks very speculative. Spot Coffee (Canada) Ltd. is a Canada-based company that designs, builds, and operates coffee cafés throughout Canada and the United States. These cafés sell coffee, sandwiches, pastries, salads, and many other food and drink items. Most of the company’s revenue comes from sales at these cafés, licensing and franchise fees, and the wholesale of roasted coffee beans. The company has a 5-year revenue growth rate of 7.52% with its stock trading at 37.5 times trailing earnings.

Youngevity International is a company that develops and distributes nutritional products and commercial coffee. It operates in two segments, Direct Selling and Commercial Coffee, but generates most of its revenue from the Direct Selling segment. It offers a wide variety of products including gourmet coffee, skincare and cosmetic products, nutritional supplements, sports and energy drinks, fashion accessories, digital products, and organic food. The company enjoys a 5-year revenue growth rate of 17.18%, and its stock has a very favorable price-to-sales ratio of 0.43.

If you’re looking for more than just an energy boost and some health benefits from coffee, you may want to consider investing your money in a coffee ETN or in the stocks of some coffee-related companies.

Disclosure: Author didn’t own any of the above at the time the article was written.