Is cookie inflation a good thing or a bad thing?

WStNN.com™ WallStreetNewsNetwork® Stockerblog™ WSNN®

Wall Street News Network: Information on stocks, bonds, real estate, investments, gold, startups, & money

Is cookie inflation a good thing or a bad thing?

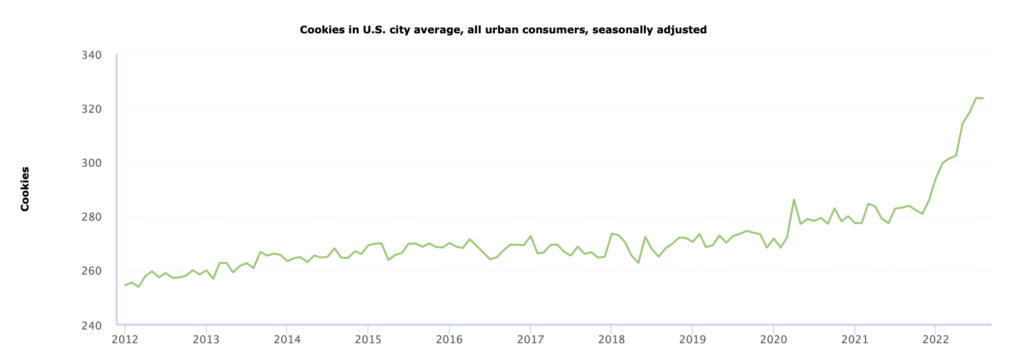

The CPI for all urban consumers, one month percent change:

by Fred Fuld III

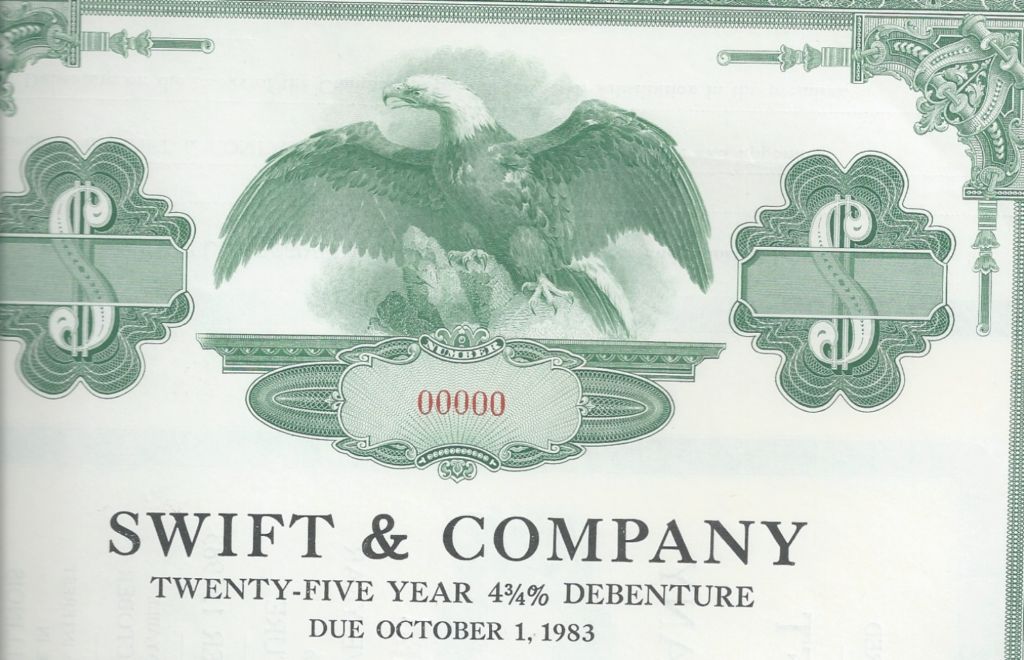

Have you considered moving out of stocks and into bonds to protect your investment portfolio? Think twice before you do.

Unless you are investing in Series I Bonds, you might want to avoid bonds at this time.

Remember, when interest rates go up, bonds drop in value. As a very simplistic example, If you have a bond paying 5%, and interest rates in general rise to 10%, a 30 year bond would drop to almost half its value.

Of course, you could sweat it out and hold on for 30 years to get your original investment back.

Even short term bonds can drop significantly, far exceeding what interest you have earned on the bond for the year.

You never know what the Federal Reserve Board will do with interest rates. Currently it looks like much higher rate hikes are in the cards due to rising inflation.

It looks like Fed Chairs are pushing for a 75 basis point (3/4%) interest rate increase for their upcoming meeting near the end of July hoping to help offset inflation.

So if rates continue to rise, how will it affect the value of your bonds?

The following shows what will happen to a 3% 30 Year Bond:

| Value of a 30 year bond | ||

| If interest rates increase | 30 year bond | |

| Interest rates | 3% bond | Drop in value |

| 3% | $1,000.00 | |

| 4% | $827.08 | 17% |

| 5% | $692.55 | 31% |

| 6% | $587.06 | 41% |

| 7% | $503.64 | 50% |

| 8% | $437.11 | 56% |

| 9% | $383.58 | 62% |

The following shows what will happen to a 3% 5 Year Bond:

| Value of a 5 year bond | ||

| If interest rates increase | 5 year bond | |

| Interest rates | 3% bond | Drop in value |

| 3% | $1,000.00 | |

| 4% | $955.48 | 4% |

| 5% | $913.41 | 9% |

| 6% | $873.63 | 13% |

| 7% | $835.99 | 16% |

| 8% | $800.36 | 20% |

| 9% | $766.62 | 23% |

The following shows what will happen to a 4% 30 Year Bond:

| If interest rates increase | 30 year bond | |

| Interest rates | 4% bond | Drop in value |

| 4% | $1,000.00 | |

| 5% | $846.28 | 15% |

| 6% | $724.70 | 28% |

| 7% | $627.73 | 37% |

| 8% | $549.69 | 45% |

| 9% | $486.32 | 51% |

| 10% | $434.39 | 57% |

The following shows what will happen to a 4% 5 Year Bond:

| If interest rates increase | 5 year bond | |

| Interest rates | 4% bond | Drop in value |

| 4% | $1,000.00 | |

| 5% | $956.71 | 4% |

| 6% | $915.75 | 8% |

| 7% | $876.99 | 12% |

| 8% | $840.29 | 16% |

| 9% | $805.52 | 19% |

| 10% | $772.55 | 23% |

Why Bond Mutual Funds are Bad

The worst possible bond investment during rising interest rates is a bond mutual fund. The reason?

There is no yield to maturity.

What that means is, if rates rise after you invest and never drop to that level again, then it doesn’t matter how long you hold onto the fund, even 50 years. You won’t get your principal back.

What can make it worse for the funds is if there are a lot of redemptions as interest rates rise and drop in value.

The fund is then forced to liquidate bonds at losses, thereby locking in losses for the whole portfolio.

Summary About Bonds

So if you have bonds in your portfolio, or you are consider buying bonds for your portfolio, make sure that you are aware of the downside.

by Fred Fuld III

The following informative interview was provided by Sachin Khajuria, the founder of Achilles Management and a former Partner at Apollo, one of the world’s largest alternative asset management firms. He has twenty-five years of investment and finance experience and holds degrees in economics from the University of Cambridge. He is also the author of Two and Twenty: How the Masters of Private Equity Always Win, which was recently released.

This interview contains a lot of great information about the private equity fund industry and the economy. Some of the topics included are as follows:

Enjoy listening to the great insights and information that Sachin Khajuria provides.

To stream the interview, click:

It may take a few seconds to load. You can also download the interview as an mp3 file by right-clicking (or Control clicking) HERE and choosing “save as”.

The book, Two and Twenty: How the Masters of Private Equity Always Win, is available through Amazon and other book stores.

Additional information can be found about Sachin Khajuria and his company at Achilleslp.com.

Enjoy the interview!

All opinions are those of Sachin Khajuria, and do not represent the opinions of this site or the interviewer. Neither this site, nor the interviewer, nor the interviewee are rendering tax, legal, or investment advice in this interview.

Affiliate links are on this page

by Fred Fuld III

I’ve been seeing so-called experts on TV explaining about ways to survive during these inflationary times. They recommend such things as spending only the bare minimum when you go to the supermarket, buy just enough gas to get you through the next few days, and avoid going on vacation.

This is about the stupidest thing you could possibly due during a rising inflationary environment.

The best thing you can do is the exact opposite. When you shop for groceries, stock up on as many non-perishable as you can, such as canned goods (soup, vegetables, fruit, seafood), peanut butter, dried fruit, protein bars, oatmeal, honey, syrup, salt, sugar, spices, and bottled water.

Why? Because prices will continue to rise. You might as well pay lower prices now and have plenty to last you for a long while, instead of buying a little now and paying higher prices a few weeks or months from now.

You may have seen a previous post, called The Amazon Inflation Rate is Running at 68% Per Year, which showed that in a recent one-year period, the average price increases from items I ordered through Amazon increased by 68%, and even if you excluded the outliers, the items that more than doubled in price, the overall average increase was still an outrageously high 38%!!!

Inflation cannot be stopped immediately. It is not a light switch that can be turned off at any moment. It is more like turning around a giant ship, which can take a long time.

So, the same situation exists with buying gas for your car. Fill it to the maximum that the gas station has set for your credit card. (I keep hearing about people saying the pump stopped at $100 or $120.) You might as well fill your tank now instead of waiting a week, and paying 25 cents a gallon more.

As for vacations, why wait? Prices for flying will continue to rise. Airlines use petroleum fuel for their jets, and since the price of oil has been rising significantly in price, the airlines have to pass that cost along to their customers, along with all the other costs related to running an airline.

Plus, if you were considering traveling overseas, there is an additional reason to take your vacation now. The U.S. dollar is very strong compared to other currencies, so your spending will go a long way in many European and Asian countries.

Therefore, you should have no guilt about spending your money now. As a matter of fact, you would be doing yourself a financial favor.

by Fred Fuld III

I’m sure you have noticed prices increasing, not just at the pump. But do you know what items have had the biggest price increases?

The following is a list of items with the biggest price increases according the the U.S. Bureau of Labor Statistics. These are the ones with a price boost of greater than 20%. year-over-year.

| Fuel oil | 43.6% |

| Gasoline, unleaded regular | 38.7% |

| Gasoline, unleaded midgrade | 35.6% |

| Gasoline, unleaded premium | 33.3% |

| Other motor fuels | 40.5% |

| Utility (piped) gas service | 23.8% |

| Used cars and trucks | 41.2% |

| Lodging away from home | 25.1% |

| Other lodging away including hotels and motels | 29% |

| Car and truck rental | 24.3% |

| Admission to sporting events | 20.9% |

| Private transportation | 22.1% |

| New and used motor vehicles | 23.5% |

You will notice that average prices of used cars and trucks is up an incredible 41.2%. Admission to sporting events was up “only” 20.9%.

Hang on. These increases are only the beginning.

By the way, the picture shown with this article is way out of date. It is from four months ago. Prices in California are much higher now.

by Fred Fuld III

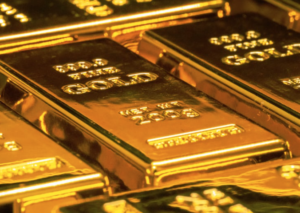

It was just back in September when I wrote the article Top Gold Mining Stocks, almost six months to the day. In the article, I listed seven gold mining companies. The following shows the returns for those stocks.

| Stock | Symbol | 9/13/22 | 3/10/22 | Gain/Loss |

| AngloGold Ashanti Limited | AU | 15.5 | 25.73 | 66% |

| Caledonia Mining Corporation Plc | CMCL | 12.36 | 13.49 | 9% |

| DRDGOLD Limited | DRD | 9.15 | 10.14 | 11% |

| Gold Fields Limited | GFI | 8.64 | 16.69 | 93% |

| Harmony Gold Mining Company | HMY | 3.28 | 5.41 | 65% |

| Kinross Gold Corporation | KGC | 5.75 | 5.66 | -2% |

| Sibanye Stillwater Limited | SBSW | 13.61 | 18.32 | 35% |

| AVERAGE | 40% |

As you can see, there was only one loser in the bunch, Kinross Gold (KGC) which was down 2%. However, all the others were up substantially. One, Gold Fields (GFT), almost doubled. The overall average return was 40%; not too shabby for a six month period.

Some studies have shown that gold may not track inflation during short time frames, but over long periods of time, gold has been considered an inflation hedge and a hedge against a downturn in the economy.

According to the U.S. Bureau of Labor Statistics, “gold prices can act as an indicator of the health of the economy. A rise in the price of gold may be a signal that the economy is struggling. As a result, in times of either a crisis or inflation, many investors turn to gold to protect their principal. By contrast, in times of economic stability, investors are more likely to turn to more speculative investments, such as stocks, bonds, and real estate. During these times, the price for gold often declines.”

(What is surprising about this statement is that stocks, bonds, and real estate are considered “speculative investments”. Does that make gold a “safe investment”?)

So now that gold has started to move up, and recently broke the $2000 an ounce price barrier, what gold mining stocks have solid ratios now.

There are currently four gold mining companies that have trailing price to earnings ratios of less than 25, forward price to earnings ratios of less than 25, and yields above 2%. You will notice that only one stock from the old list, Agnico, made the cut for the new list.

Agnico Eagle is a Canadian based mining company with mines in Canada, Sweden, and Finland. The stock has a trailing P/E ratio of 23.3, a forward P/E ratio of 24.33, and pays a yield of 2.28%. Annual earnings per share growth for the last five years is 79%.

AngloGold, based in Johannesburg, South Africa, has mines in Africa, North America, South America, and Australia. The stock trades at 16.9 times trailing earnings and 12 times forward earnings. The dividend payout rate is 2.11%. Annual earnings per share growth for the last five years is 97%.

The Canada based company, B2Gold, has three operating mines in Mali, the Philippines, and Namibia. The stock has a very favorable P/E ratio of 10.7 and forward P/E of 10.4. Even the price to earnings growth ratio is a commendable 0.53. Annual earnings per share growth for the last five years is 33%.

Sibanye is a South African company that has mines in South Africa, the United States, Zimbabwe, Canada, and Argentina. The stock has an excellent price to earnings ratio of 6.2, with a forward P/E of 12.2. Annual earnings per share growth for the last five years is 41%.

Maybe one of these mining stocks can provide your portfolio with a pot of gold.

Disclosure: Author owns BTG

by Fred Fuld III

You have seen the headlines during the last several months. You have noticed the price increases on Amazon (AMZN), in your supermarket, and even at the dollar stores (which should probably now be called the $1.25 stores). Have you considered using gold as an inflation hedge?

Inflation is here and it’s getting worse. Investors and traders that understand this are now looking for ways to profit from inflation.

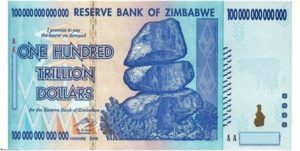

Of course no one expects hyperinflation, as was seen in Zimbabwe in 2008.

In Zimbabwe, the country’s peak month of inflation is estimated at 79.6 billion percent month over month, and 89.7 sextillion percent year over year in mid-November of 2008. That’s an inflation rate in numerical terms of 89,000,000,000,000,000,000,000%.

Back then, it cost billions of dollars just to buy basic food items. Inflation was so bad that the country allowed currencies from other countries to be used in April 2009. In 2015, Zimbabwe switched to the U.S. dollar as its national currency.

In 2019, Zimbabwe reintroduced the Zimbabwe dollar, but unfortunately, hyperinflation has hit the country again, measuring 737% last year.

So what is a trader and investor to do? Here are several ways to make gold work for you.

Gold has long been considered a primary inflation hedge. Over the last 20 years, the price of gold has increased by 597%, which works out to an annualized return of 10.19%. Taking inflation into consideration, gold has gone up by 335%, or 7.622% annualized.

Many studies have shown that gold has provided superior returns during times of inflation. In addition, according to a study at the Stern School of Business at New York University, “overall gold by itself is a safe haven with respect to exhibiting lower volatility in response to shocks or negative return days.”

The big question is, if you want to invest in gold, how should you do it?

Physical gold means gold that you can hold in your hot little hands. This could either be gold bullion or gold coins.

Gold bullion is sometimes referred to as gold bars, similar to the bars in Fort Knox. They can be as small as one gram or as large as 400 ounces (27.5 pounds).

The big advantage of gold bullion is privacy. Bullion bars can be kept anywhere: a home safe, a safe deposit box, or in the ground. Another advantage is that bullion is generally less expensive than gold coins, even bullion gold coins.

Gold bullion coins are coins that are issued by governments with a very high gold content, but very little or no numismatic value, but are issued as legal tender. In other words, they sell for very close to the price of gold. These coins include the American Gold Eagle and the Canadian Maple Leaf.

These coins also have the benefit of privacy, but they are also issued in various denominations, making them easier to trade. For example, if you have a one ounce gold bar but you want to sell one quarter of the gold, you would be stuck. However, you do have the ability to own four American Eagle quarter-ounce gold coins, or even ten 1/10th ounce coins.

Many investors believe that the gold coins have better liquidity than bullion. However, the premium on gold coins is higher than the premium on bullion, and the smaller the denomination of the coin, the higher the premium.

Numismatic gold coins are coins which have value due to their scarcity, physical appearance, condition, and many other factors. They are collected by coin collectors.

The big advantage is that the value of these coins can increase far more than the value of gold, and can even go up in price if the gold price stays the same or even drops. They are less liquid than bullion coins and have a much bigger spread (the price at which you pay for the coin versus what you can sell it for). The other disadvantage is that the coins have a much higher premium than bullion coins.

There is one big estate tax advantage to owning U.S. numismatic gold coins. Talk to your accountant about it. It is currently legal and above board as far as I know, but I am not an accountant or tax attorney. Consult yours.

Gold ETFs are Exchange Traded Funds that have a goal of tracking the price of gold. There are many of them including SPDR Gold Shares (GLD), iShares Gold Trust (IAU), and SPDR Gold MiniShares Trust (GLDM).

There are even some leveraged gold ETFs, such as ProShares Ultra Gold (UGL), which has a goal of providing twice the daily leverage of gold prices.

There are many gold mining companies to choose from. The smaller companies are referred to as junior miners (not minor miners). Some of the bigger ones include Newmont Mining (NEM), Barrick Gold (GOLD),AngloGold Ashanti (AU), and Kinross Gold (KGC).

Gold Royalty Trusts do not do any mining. What they do is provide money to mining companies in return for receiving a stream of income based on a percentage of revenues or percentage of gold production.

Some of the biggest gold trusts are Franco-Nevada (FNV), Wheaton Precious Metals (WPM), Royal Gold (RGLD), and Osisko Gold Royalties (OR).

Gold Miners ETFs are Exchange Traded Funds that invest in gold mining stocks. VanEck Vectors Gold Miners ETF (GDX) is the largest of these ETFs. VanEck Junior Gold Miners ETF (GDXJ) holds the smaller (junior) mining companies. Direxion Daily Gold Miners Index Bull 2x Shares (NUGT) is a double bullish ETF.

One other way to invest in gold, which is the most speculative way, is through gold futures. These are exchange-traded contracts to buy or sell a specific amount of gold in the future at a specified price. The returns can be substantial but so are the risks, as your losses can far exceed the original investment that you put up.

Many financial advisors recommend that you hold a small amount of gold, up to 5% to 10% of your portfolio as a hedge. Hopefully, gold will make your portfolio sparkle and shine.

Disclosure: Author is long AMZN, GLD, WPM, and OR.

by Fred Fuld III

You might have noticed price increases at the pump. In California, if you can find gas for less than $5 a gallon, even regular, it’s a bargain.

Or maybe when you checkout at the supermarket, you noticed that your bill is a bit higher than normal.

If you have noticed these things, then you are starting to feel the effects of inflation.

According to the United States Government Bureau of Labor Statistics, in October, the Consumer Price Index for All Urban Consumers rose by 6.2 percent over the last 12 months.

I personally think that that rate may be a bit too low. Why? I did my own analysis of a random sample of purchases made through Amazon (AMZN) over the last twelve months, comparing what I paid in the past to what the current price is now, and the results were shocking.

These items included such things as office supplies, food, vitamins, toothpaste, book, disposable masks, garden hose, and even a robot vacuum.

The lowest increase in price was for a 40 ounce bag of raw whole natural Blue Diamond almonds, which increased in price by only 5%.

The next lowest increase had a substantially higher price rise. Scotch Heavy Duty Shipping Packaging Tape went up by 15%.

Now for the big increases. Surprisingly, snack foods had the greatest rise in prices. Crunchmaster Multi-Seed Crackers almost tripled in price by rising 194% and Sensible Portions Garden Veggie Chips spiked by 173%.

Both BROOKSIDE Dark Chocolate Candy with Acai & Blueberry, and a 21 Ounce Bag Dulzura Borincana Sesame Seed with Honey and Almonds doubled in price. (I guess now you can see the kinds of snacks that I like.)

However, what is most interesting is the overall average of the price increases. Based on the rate of increase in cost over the last year for more than 25 different items purchased on Amazon, the average of those percentage increases is 68%!!!

Even if you exclude the high increase outliers, the ones that more than doubled, the overall average price increase of the remaining items is 38%, still extraordinarily high, and way above what the government reported.

Here is a list of the items below:

| Anycolor Compatible Label Tape Replacement for Brother M Tape | 39% |

| Blue Diamond Almonds, Raw Whole Natural, 40 Oz | 5% |

| BROOKSIDE Dark Chocolate Candy , Acai & Blueberry, 21 Ounce Bag | 148% |

| BUMBLE BEE Premium Light Tuna in Water, Ready to Eat Tuna Fish | 21% |

| Columbian Clasp Envelopes, 10 x 13 Inches, Brown Kraft, 100 Per Box | 44% |

| Crunchmaster Multi-Seed Crackers, Artisan Cheesy Garlic Bread, 4 Ounce | 194% |

| Disposable Filter Masks, Eventronic 3 Ply Face Masks, For Home & Office (50 Pcs) | 20% |

| Dulzura Borincana Sesame Seed with Honey and Almonds | 134% |

| FIJI Water Artesian Water, 16.9 Fl Oz (Pack of 6) | 34% |

| Filexec, 93630, Art Presentation Book, 24 Pocket, 11″ x 14″, 1 Each Black | 25% |

| Hammermill Paper, Copy Plus Paper, 8.5 x 11 Paper, Letter Size, 20lb Paper, 1 Ream | 53% |

| Hermard 50ft Expandable Garden Hose with 9 Function Nozzl | 32% |

| KIND Bars, Dark Chocolate Mocha Almond, Gluten Free, 1.4 Ounce, 12 Count | 26% |

| Krazy Glue Home and Office Brush-On Glue, 0.18 oz | 74% |

| NOW Supplements, Vitamin D-3 5,000 IU, High Potency, 240 Softgels | 32% |

| Polysporin First Aid Topical Antibiotic Ointment with Bacitracin Zinc | 54% |

| Puritans Pride Lutein 20 mg with Zeaxanthin Softgels, 120 Count | 94% |

| Samsung POWERbot R7040 Robot Vacuum | 159% |

| Scotch Tape Heavy Duty Shipping Packaging Tape, 1.88 Inches x 800 Inches, 1 Pack | 15% |

| Sensible Portions – 30357 Garden Veggie Straws, Sea Salt, 1 oz. (Pack of 8) | 20% |

| Sensible Portions Garden Veggie Chips, Sea Salt, 7 oz. | 173% |

| Sensodyne Pronamel Intensive Enamel Repair Toothpaste for Sensitive Teeth | 62% |

| Seresto Flea and Tick Collar for Dogs, 8-Month Flea and Tick Collar for Large Dogs Over 18 Pounds | 38% |

| The Family Upstairs: A Novel | 114% |

| Triple Leaf Tea Jasmine Green Tea, Decaffeinated, 20 Count | 25% |

| V8 Juice, Original 100% Vegetable Juice, 11.5 Ounce Can (Pack of 24) | 138% |

| AVERAGE RATE OF INCREASE | 68% |

| AVERAGE RATE OF INCREASE excluding doubling outliers | 38% |

If you are an avid Amazon shopper like me, you can do your own analysis. Just click on the Orders link, choose 2020, click on View Order Details to get the price you paid, then click on the Order Again button to see what the current price is. Once you have that, subtract the price paid from the current price, then divide that result by the price paid, and that is your percentage increase.

Of course, maybe I have a tendency to only buy things that happen to have a way of significantly rising in price. Or maybe not.

This increase in prices certainly doesn’t come close to Zimbabwe’s previous hyperinflation, whereby $100 trillion dollar bills were issued. However, it is a wake-up call.

Let me know what your Amazon inflation rate is.

Disclosure: Author owns AMZN and also has a short vertical call position in AMZN.

by Fred Fuld III

The following informative interview was provided by Dr. Mark Skousen, a financial economist, editor of the Forecasts & Strategies financial newsletter since 1980, and Presidential Fellow at Chapman University, where he recently received the “Most Favorite Professor” Award. He is also the producer of FreedomFest, “the world’s largest gathering of free minds.” He is the author of several books, including The Maxims of Wall Street, now in its 10th edition.

We cover a lot in this interview, including:

He even gives the name of a gold mining stock that he likes, which trades for less than $5 a share and pays a yield of over 3%!

The Dr. Mark Skousen Interview

Enjoy listening to the great insights and information that Dr. Skousen provides:

To stream the interview, click:

It is a long interview, so it may take a few seconds to load. You can also download the interview as an mp3 by right-clicking (or Control clicking) HERE and choosing “save as.”

Please note that all of Dr. Skousen’s books can be ordered directly from SkousenBooks.com, and they will be autographed and delivered with free shipping.

The Maxims of Wall Street – New 10th Anniversary Edition

A Viennese Waltz Down Wall Street

The Making of Modern Economics

EconoPower: How a New Generation of Economists is Transforming the World

His other books can be found at SkousenBooks.com.

Information about the Forecasts and Strategies Newsletter and the trading services can be found at MarkSkousen.com.

Enjoy the interview and Happy Investing!

All opinions are those of Dr. Mark Skousen, and do not represent the opinions of this site or the interviewer. Neither this site, nor the interviewer, nor the interviewee are rendering tax, legal, or investment advice in this interview.