by Fred Fuld III

Let’s dive into the prospects for gold prices in 2025 and explore the various ways to invest in gold, along with their pros and cons. I’ll keep this grounded in economic trends and practical considerations as of March 21, 2025.

Prospects for Gold Price Increases in 2025

Gold prices are influenced by a mix of macroeconomic factors, geopolitical events, and market sentiment. Here’s what could drive gold’s value this year:

- Inflation and Currency Weakness: Central banks, particularly the Federal Reserve, have been navigating inflation and interest rate policies. If inflation persists or if confidence in fiat currencies like the U.S. dollar wanes (say, due to excessive money printing or debt concerns), gold often benefits as a “safe haven” asset. As of now, inflation has cooled somewhat from its 2022 peak, but any resurgence could push gold higher.

- Interest Rates: Gold doesn’t pay interest, so when real yields (adjusted for inflation) on bonds are low or negative, gold becomes more attractive. If the Fed cuts rates in 2025 to stimulate growth, or if rates stay steady but inflation ticks up, gold could see a boost. Conversely, aggressive rate hikes would pressure gold prices downward.

- Geopolitical Uncertainty: Ongoing tensions—think U.S.-China relations, conflicts in Eastern Europe, or Middle East instability—tend to drive investors toward gold. If 2025 brings more chaos (not hard to imagine), demand could spike.

- Central Bank Buying: Countries like China, India, and Russia have been stockpiling gold to diversify reserves away from the dollar. This trend, if it accelerates, supports higher prices.

- Supply Constraints: Gold mining output has plateaued in recent years. If demand outpaces supply—especially with industrial uses (e.g., electronics) growing—prices could climb.

Outlook: Analysts often project gold prices based on these drivers. As of early 2025, gold’s hovering around $3,000 per ounce. Some forecasts suggest it could hit $3,500 if inflation or geopolitical risks flare up, though a stronger dollar or robust equity markets might cap gains. It’s a tug-of-war between bullish and bearish forces—nothing’s certain, but gold’s got a decent shot at appreciating if uncertainty reigns.

Ways to Invest in Gold

Here are the main avenues for getting exposure to gold, each with its own flavor:

- Physical Gold (Bars, Coins, Jewelry)

- How: Buy bullion (e.g., 1 oz coins like American Eagles or Canadian Maple Leafs) or jewelry from dealers, banks, or mints.

- Advantages:

- Tangible asset—you own it outright.

- No counterparty risk (unlike paper gold).

- Can be a hedge during extreme crises (e.g., currency collapse).

- Disadvantages:

- Storage costs (safes, vaults) and security risks (theft).

- Premiums over spot price (5–10% for coins, more for jewelry).

- Illiquid—selling takes effort and may involve dealer markups.

- Gold ETFs (Exchange-Traded Funds)

- How: Buy shares of funds like SPDR Gold Shares (GLD) or iShares Gold Trust (IAU) via a brokerage. These track gold prices and are backed by physical gold.

- Advantages:

- Easy to buy/sell like stocks—highly liquid.

- No storage hassle (the fund holds the gold).

- Lower costs than physical gold (expense ratios ~0.25–0.4%).

- Disadvantages:

- No physical possession—if society collapses, you’re out of luck.

- Management fees erode returns over time.

- Counterparty risk (trust in the fund custodian).

- Gold Mining Stocks

- How: Invest in companies like Newmont or Barrick Gold via stock markets.

- Advantages:

- Potential for amplified gains—if gold rises 10%, miners might jump 20–30% due to leverage.

- Dividends possible from profitable firms.

- Disadvantages:

- Higher volatility—tied to company performance (e.g., labor strikes, bad management).

- Less direct correlation to gold prices than bullion or ETFs.

- Operational risks (mine closures, environmental regs).

- Gold Futures and Options

- How: Trade contracts on exchanges like COMEX, betting on future gold prices with leverage.

- Advantages:

- High leverage—control large positions with little capital.

- Potential for big profits if you time it right.

- Disadvantages:

- High risk—leverage cuts both ways, and losses can exceed your initial investment.

- Complex and time-sensitive (contracts expire).

- Not for beginners—requires market savvy.

- Digital Gold or Gold-Backed Tokens

- How: Buy fractional gold via platforms (e.g., Pax Gold, Tether Gold) where ownership is tokenized on a blockchain, often redeemable for physical gold.

- Advantages:

- Accessible—buy small amounts (e.g., $10 worth).

- Combines digital ease with gold’s stability.

- Some platforms offer redemption for physical gold.

- Disadvantages:

- Counterparty risk—depends on the issuer’s solvency.

- Regulatory uncertainty in some regions.

- Fees can be higher than ETFs.

Weighing the Options

- If you want safety and control: Physical gold’s your pick, but it’s costly to manage and not great for quick trades.

- If you’re after convenience: ETFs strike a balance—liquid, low-cost, but you’re betting on the system holding up.

- If you’re a risk-taker: Mining stocks or futures offer big upside, but you could get burned.

- If you’re tech-savvy: Digital gold’s emerging, though it’s still niche and trust-dependent.

Final Take

Gold’s price in 2025 hinges on how chaotic the world gets—more chaos, more shine. For investing, match your choice to your goals: long-term hedge (physical/ETFs), speculative play (stocks/futures), or modern twist (digital). Each has trade-offs, so it’s about what you can stomach—both in risk and logistics.

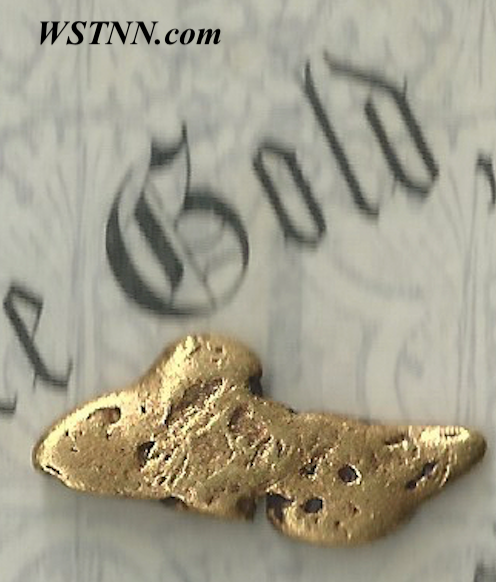

The picture shows the 44 pound gold nugget at the Ironstone Heritage Museum. It is 98% pure gold.