by Fred Fuld III

Some of you may know Gisele Bundchen as the famous Brazilian supermodel. Some of you may know Gisele as the wife of American football player Tom Brady. Some of you may know her as both.

Unfortunately, the recent news about her relates to marital issues with Brady.

However, What Gisele should be known for is her intelligence, her beauty, and her business acumen. As a matter of fact, back in 2007 when the U.S. dollar was weak, she refused US dollars for some of her contracts and requested Euros instead.

She was the world’s richest supermodel as early as 2007, and has held that title until 2015, according to Forbes.

Back in 2007, I created the Gisele Bündchen Stock Index, which tracked the stocks that Gisele was connected to, primarily as a spokesperson or actress. The article can still be found in our Stockerblog predecessor website.

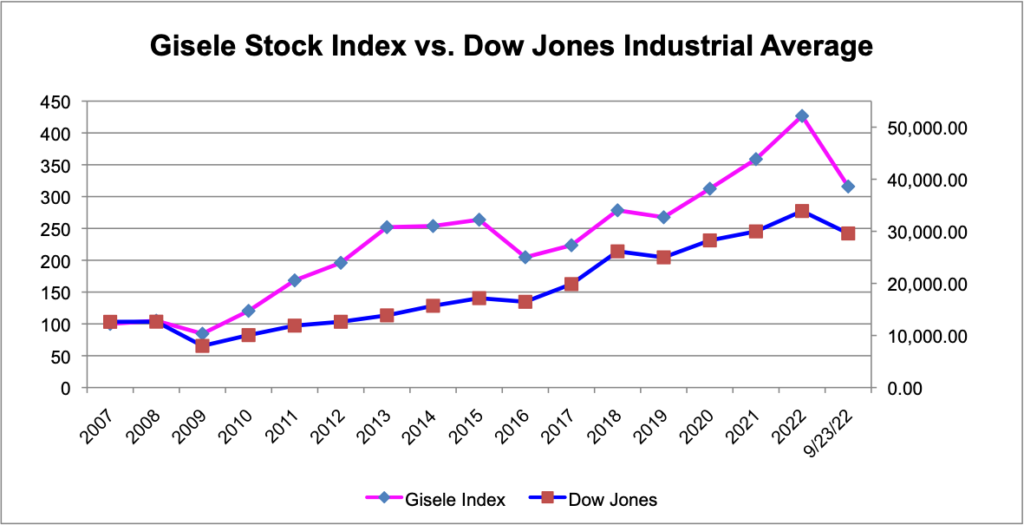

I tracked her stock index against the Dow Jones Industrial Average since then, and over the years, the Gisele stock index has continued to outperform, which you can see in the chart below. Her index even held up better than the Dow during the 2008 stock market crash.

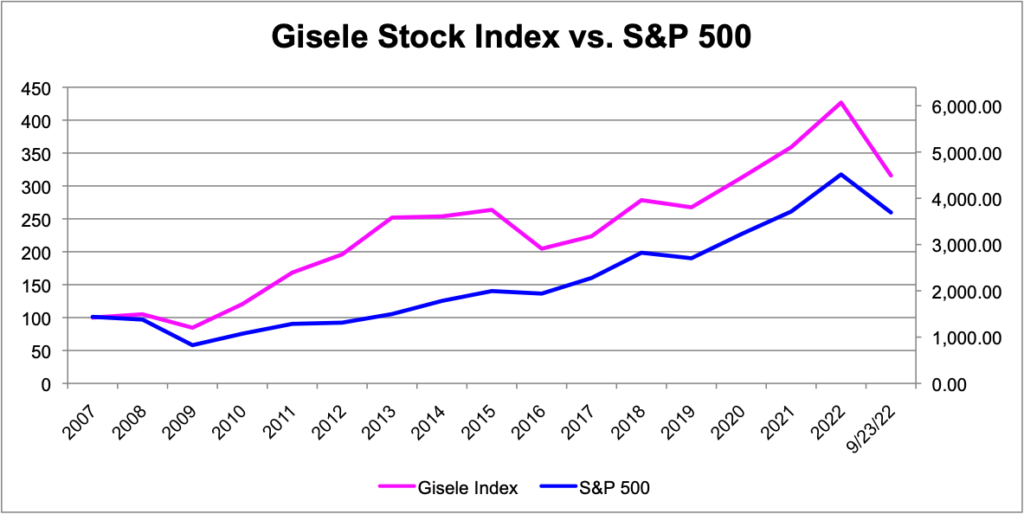

Most stock market investors and stock traders today prefer to look at the S&P 500 as opposed to the Dow, as it more reflects the stock market as a whole.

So here is the Gisele index versus the S&P 500.

Data Source: Yahoo! Finance: Historical Prices

The following companies were included in the current index with information regarding Gisele’s connection. Over the years, a couple stocks were dropped due to lack of trading data for non-US companies, and added due to additional celeb endorsements.

LVMH Moët Hennessy Louis Vuitton S.A. (LVMUY) owns several companies that Gisele was the spokesperson for, including Louis Vuitton (a luxury French fashion company), Givenchy ( French retailer of clothing, accessories, perfumes and cosmetics), Guerlain (the oldest perfume house in the world), and Céline (a French ready-to-wear and leather luxury goods brand). Since 2007, the stock has increased by 733%.

She was also the advertising campaign face for Ralph Lauren Corp. (RL). That stock has gone up 27% since 2007.

Gisele was the celebrity endorser for Vivo Participacoes S.A. (VIV), the largest mobile phone service provider in Brazil and in South America. The stock has actually dropped 9% since 2007.

She starred in the comedy, Taxi, in her movie debut, and The Devil Wears Prada , both produced by 20th Century Fox, formerly a division of News Corp. (NWS) at the time the Gisele Index was created. The stock, which was actually involved in a spinoff and skews the return, is down 31% since that time.

For Disney (DIS) she was a celebrity endorser and appeared in the ‘Year of a Million Dreams’ celebration photoshoot. Disney has moved up 241% since 2007.

Gisele was a spokesperson for Procter & Gamble (PG), increased Pantene’s sales in Brazil by 40% during her celebrity endorsement. The stock has had a solid return of 230%.

Finally, she was the spokesperson for the Volkswagon (VLKAY) TV commercials. The stock has had a superior return of 748% since 2007.

Based on the above stocks in the portfolio, the Gisele Index has increased by 215.89%, versus 134.44% for the Dow and 156.79% for the S&P 500.

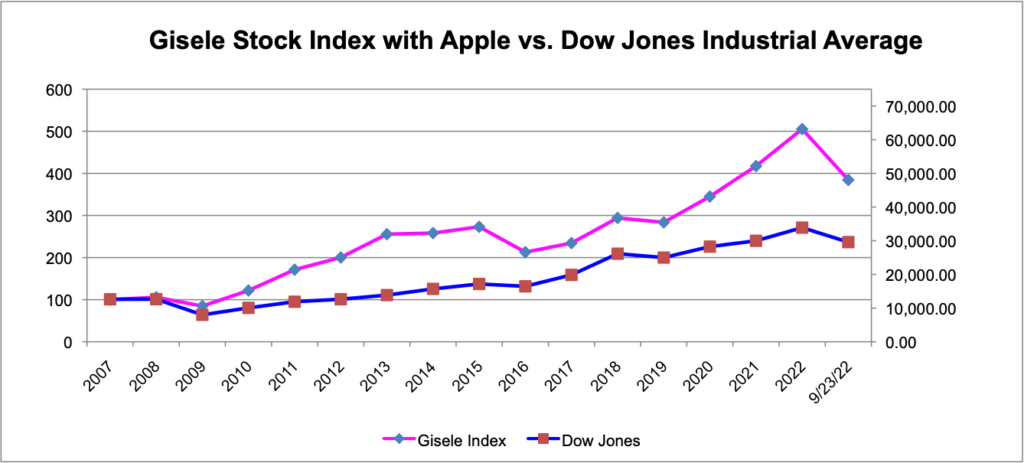

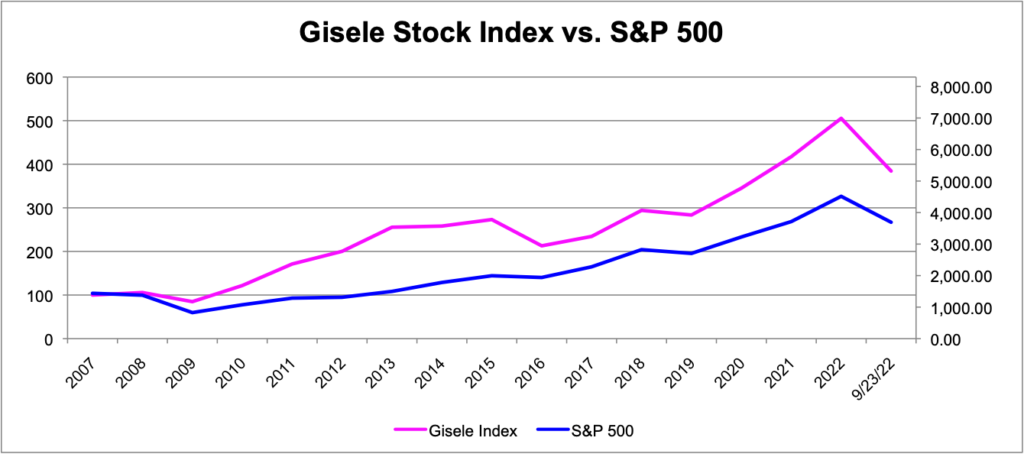

There is one other stock that Gisele was involved with. She appeared on the Apple (AAPL) ‘Get a Mac’ advertisements to promote the new line of Macintosh’s.

Over the years, I have left Apple out of the index because the return on it was so gargantuan, I thought it would really skew the returns and the charts.

Do you know how much Apple has increased since 2007? The stock has gone up by 5,663%!!!

Here are the charts for the Gisele Index which INCLUDES Apple.

Data Source: Yahoo! Finance: Historical Prices

By including Apple in the index, the return is boosted to 284%, compared to the 216% without it.

Maybe some of these stocks might look attractive to you at the right price. At some point they should become fashionable, and may continue to outperform.

Prices are beginning of year first trading day close, adjusted for splits, dividends, and capital gains distributions. The Gisele Index is a price-weighted index, similar to the Dow Jones Industrial Average.

Disclosure: Author owns AAPL and DIS.