by Fred Fuld III

Last year, I posted an article about the political ETFs, which track the investments of politicians based on the reporting of their transactions, which politicians are legally required to provide.

I mentioned in that article that year-to-date, Democrats were far outperforming the Republicans.

At the end of the year, I posted a followup article which showed that Democrats were still outperforming.

Let’s take a look at how these stocks are doing this year.

DJT

First of all, there is the Trump Media & Technology Group (DJT), which is a media and technology company founded by former U.S. President Donald Trump in 2021. DJT was established with the goal of creating an alternative to mainstream media and tech platforms, which Trump and his supporters claim limit conservative voices. The company’s flagship project is Truth Social, a social media platform that aims to provide a space for free speech and minimal content moderation.

In addition to Truth Social, DJT has announced plans for other ventures, such as a subscription-based video-on-demand service called TMTG+, which would feature a mix of entertainment, news, and documentary content catering to a conservative audience. The company has faced both praise and controversy, navigating legal and regulatory challenges while securing funding and building partnerships to expand its media footprint. The company aims to position itself as a significant player in the conservative media landscape and a counterbalance to established tech giants.

In regards to the return on the stock, it is up over 201% so far this year, as of the time this article is being written. The company’s a market cap of $10 billion, is debt free, and is currently generating negative earnings.

Congressional Investors

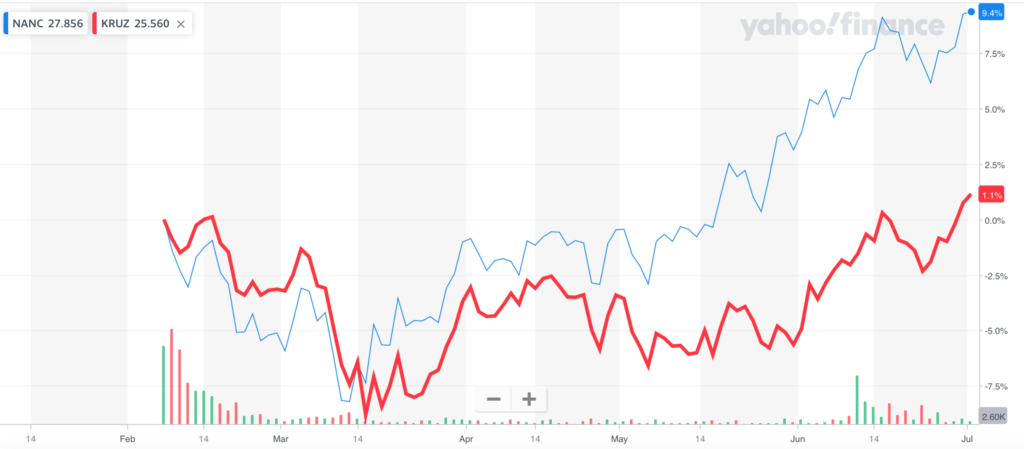

The Democrats, based on the return of the Unusual Whales Subversive Democratic Trading ETF (NANC), is up over 25.8% so far this year. The ETF invests in companies that sitting Democratic members of United States Congress and/or their families also have reported to have invested in. The expense ratio is 0.75%.

As for the Republicans, Unusual Whales Subversive Republican Trading ETF (KRUZ), trailing far behind, up only 14.85%. It invests in stocks that sitting Republican members of United States Congress and/or their families also have reported to have invested in. The expense ratio is 0.75%.

Political Contributions

There is also the Political Contribution Comparison, which shows the returns of companies that make political contributions to Democratic versus Republican candidates and political action committees.

This analysis shows the following returns.

The Democratic Large Cap Core ETF (DEMZ) invests in large cap companies that make political contributions to Democratic Party candidates and political action committees above a certain threshold. Total return so far for the year is 22.1%.

The Point Bridge America First ETF (MAGA) has a goal of investing in companies that are highly supportive of Republican candidates. The return so for is just 16.8%.

Semi-Political EFTs

Also, there are the semi-political ETFs. These ETFs are somewhat different in that they leave the politicians out of the analysis, both as investors and political donees. These ETFs have very different returns.

The God Bless America ETF (YALL) is an ETF that screens out companies that support liberal political activism and social agendas. It was up an incredible 36.7% for the year.

The American Conservative Values ETF (ACVF) invests in stocks that meet its politically conservative criteria. The annual return was a positive 23.1%.

One ETF that is considered by many to be a “liberal” ETF is the SPDR MSCI ACWI Climate Paris Aligned ETF (NZAC). It is for “investors seeking to implement net-zero strategies and address climate change in a holistic way”. The ETF is up 17.8% year-to-date.

Libertarians

A Libertarian play is the Global X MSCI Argentina ETF (ARGT) due to the fact that Argentina now has a libertarian president. This fund is up about 45% this year, far outpacing the S&P 500, which is up 22.4%. ARGT has a market cap of $394 million, a price to earnings ratio of 20.45, and even pays a dividend with a yield of 1.12%. The expense ratio is 0.59%.

Finally, there is the Freedom 100 Emerging Markets ETF (FRDM) which seeks to invest in countries with higher personal and economic freedom scores. The ETF is up 8.32% this year.

Most of the above have extremely low market caps of less than $200 million, and wide bid and asked spreads, with limited liquidity.

The next couple weeks should be interesting, not just for politics and the election, but for the political ETFs. So now, not only do you have many choices of presidential candidates, you also have many political ETF choices.

Disclosure: Author owns ARGT.