The following slides are from the MoneyShow presentation, Leading Cannabis Stocks, presented on February 9, 2022:

Disclosure: Author owns IIPR.

WStNN.com™ WallStreetNewsNetwork® Stockerblog™ WSNN®

Wall Street News Network: Information on stocks, bonds, real estate, investments, gold, startups, & money

by Fred Fuld III

About a week ago, I heard an analyst on CNBC being interviewed about meme stocks, although he didn’t pronounce it “meeem”, he pronounced it “me-me”. Do you think it was accidental, through ignorance, or on purpose with a hidden meaning?

Whatever you call them, the meme stocks have had a wild ride last year. Surprisingly, a few of them performed extremely well, but many ended up dropping over 40% for the year.

Interestingly, the top performers were GameStock, I mean GameStop (GME) (did I type it that way accidentally or on purpose?), up 688%, and AMC Entertainment (AMC), which rose by 1183%.

The memes that tanked the most were Clovis (CLOV) down 78% and ContextLogic Inc. (WISH), which dropped by 83%.

The following is a list of the meme stocks and semi-meme stocks along with the January 1 to December 31 performance for the year 2021.

| GME | 688% |

| AMC | 1183% |

| CLOV | -78% |

| CRON | -43% |

| DASH | 4% |

| FVRR | -42% |

| HOOD | -49% |

| IQ | -74% |

| OTLY | -61% |

| WE | -27% |

| WISH | -83% |

| BB | 41% |

| SNDL | 22% |

| BYND | -48% |

| SLV | -12% |

Maybe we will see some meme action again this year. What do you think?

Disclosure: Author owns SLV and HOOD.

by Fred Fuld III

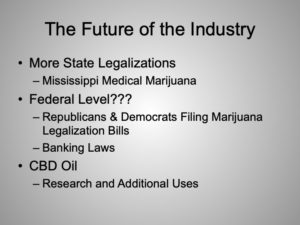

In case you missed some of the propositions in the latest election, five more states have just followed the lead of Colorado, California, and many other states. The legalization of cannabis propositions have all passed. The five states are as follows:

South Dakota – Approved the medicinal use and recreational use of marijuana.

Mississippi – Approved the medical use of marijuana.

Montana – Approved the recreational use of marijuana.

Arizona – Approved the recreational use of marijuana.

New Jersey – Approved the recreational use of marijuana.

So what has this done for the cannabis stocks? It took investors a few days to process (and a few days for most of the votes to come in), but most of the marijuana stocks skyrocketed on Friday.

Here are just a few that got high:

It will be interesting to see which ones maintain their strength. Some may get higher and higher, others may go up in smoke.

Disclosure: Author didn’t own any of the above at the time the article was written.

by Fred Fuld III

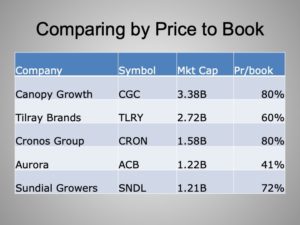

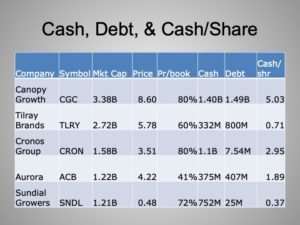

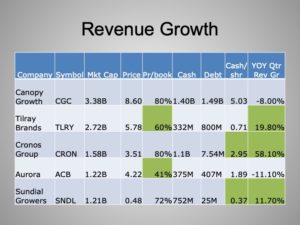

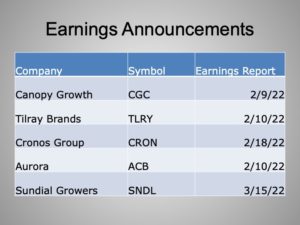

During the last twelve months, many of the cannabis stocks, such as (TLRY) and Canopy Growth (CGC), have been hit hard with some stocks, such a Tilray (TLRY) dropping 76% and Canopy Growth (CGC) down 54%. Some investors and traders think that the marijuana stocks may have hit bottom and there may be some buying opportunities.

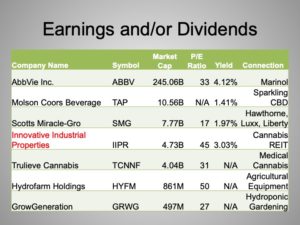

However, if you are a relatively conservative investor, you probably want to receive a dividend in return for the risk you are taking. Luckily, there are some cannabis stocks that provide investors with a decent dividend yield.

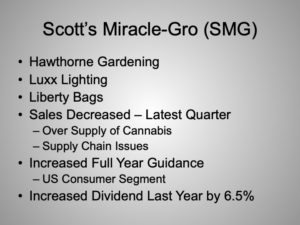

One example is Scotts Miracle-Gro Company (SMG), which has a couple divisions in the marijuana industry. Its Hawthorne Gardening Company division purchased General Hydroponics which manufactures and sells products for marijuana growers. Scotts has also invested in the hydroponics company AeroGrow International (AERO) which sells products to the small scale grower. Scotts’ current yield is 1.92%. Last August, the company raised its dividend to 58 cents per share, an incense of 5.5% over the previous quarter. The dividend has increased on an annual basis since 2015. The stock has a trailing price to earnings ratio of 15 and a forward PE of 22.

AbbVie Inc. (ABBV) is a seller of Marinol, also known as Dronabinol, a form of tetrahydrocannabinol, one of the main psychoactive ingredients of marijuana. The company has been paying quarterly dividends and has increased the annual dividend every year since 2013. AbbVie’s annual forward dividend yield is 5.77%. The company just raised its dividend to $1.07 per share per quarter, a 9.3% increase. The stock trades at 37 times trailing earnings and 8.5 times forward earnings.

Innovative Industrial Properties Inc. (IIPR), which trades on the New York Stock Exchange, owns, manages, and leases real estate to state licensed cannabis growing businesses. The company has increased dividend every quarter for the last four quarters, the latest dividend increasing my 28%. The company pays a dividend yield of 4.25%. The stock trades at 62 times trailing earnings and 20 times forward earnings.

Horizons Marijuana Life Sciences Index ETF (HMLSF) is an exchange traded fund that invests in many companies involved in the marijuana industry. It has a yield of 12%, based on its latest quarterly payment of $0.202 per share. The reason why the dividend income is so high is because most of the income comes from fees and interest from securities lending. This ETF’s largest holdings are:

Altria (MO) is primarily in the tobacco business, as it manufactures and markets cigarettes and smokeless tobacco. The company invested over a billion dollars in Cronos Group (CRON), the Canadian marijuana company. The stock pays a generous yield of 7.0%.

Molson Coors (TAP) is the seventh largest beer maker in the world. The company is in partnership with HEXO (HEXO) to produce cannabis-infused beverages in Canada. Molson Coors yields 4.05%.

Constellation Brands (STZ), which produces and markets beer, wine, and liquor, has a major ownership of shares in the Ontario, Canada based cannabis company Canopy Growth (CGC). Constellation has a dividend yield of 1.56%.

To be blunt about it, here’s the straight dope. Maybe some of these stocks will get high, and give you a smoking portfolio from this budding industry. You may even hit the jack pot. Just make sure you weed out the bad stocks, because if you don’t, your portfolio will take a hit and go up in smoke.

Don’t forget to read:

Exclusive Interview with Chet Billingsley CEO of Mentor Capital on the Marijuana Industry

Is Apple Getting into the Marijuana Industry?

Disclosure: Author owns CGC and IIPR.

by Fred Fuld III

Many of the cannabis related stocks have been burned during the last year, which makes them possible tax sale opportunities.

A tax selling stock is a stock that is currently selling for a low price due to heavy year-end selling for tax purposes, but was trading at much higher levels earlier in the year.

As the year-end approaches, many investors employ the technique called tax harvesting , which is the selling of loser stocks to offset any gains that may have been established during the year.

With all the heavy selling, the price of the stocks that have had big drops tends to drop far more than what would normally take place during the rest of the year.

So traders and investors are on the lookout for stocks that are heavily hit, hoping for a significant bounce in January, once the tax selling is over.

So if you are looking for these types of stocks, here is a selection of some marijuana stocks that have dropped by over 15% year-to-date, with five of then sinking by more than 50%.

| Stock | Symbol | YTD Return |

| Aphria | APHA | -17% |

| Aurora Cannabis | ACB | -28% |

| Cannabis Sativa | CBDS | -78% |

| Canopy Growth | CGC | -28% |

| Cronos | CRON | -25% |

| Hexo | HEXO | -38% |

| Mentor Capital | MNTR | -60% |

| Sundial Growers | SNDL | -55% |

| Terrra Tech | TRTC | -59% |

| Tilray | TLRY | -69% |

Hopefully some of these stocks will get high in January.

Disclosure: Author owns CBDS, CGC, MNTR, and has a long option position in ACB.

by Fred Fuld III

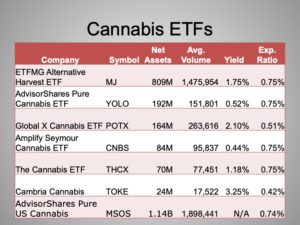

If you think that marijuana is a growth industry and you aren’t sure which is the best cannabis stock to invest in, you have an alternative. Or maybe you are looking for an easy way to play the tax loss pot stocks.

The alternative is investing or trading a cannabis ETF, of which there are several.

The largest one by market cap and volume is the ETFMG Alternative Harvest ETF (MJ), which also happens to be the oldest, founded in 2015. The ETF has an expense ratio of 0.75% and pays a high yield (no pun intended) of 4.99%. Its two largest holdings are GW Pharmaceuticals (GWPH) and Cronos (CRON).

The other cannabis related ETF that pays a yield is the AdvisorShares Vice ETF (ACT), however, marijuana stocks make up a limited amount of the portfolio as it also invests in alcohol and tobacco companies. It pays a yield of 1.56%.

A purer play is the AdvisorShares Pure Cannabis ETF (YOLO), which was founded this year. Its largest holding is Village Farms International (VFF) and the second largest is Innovative Industrial Properties (IIPR).

The following is a list of all the major cannabis ETFs.

| Fund Name | Symbol | Expense Ratio | Yield | Founded | Largest Holding | 2nd Largest Holding |

| AdvisorShares Pure Cannabis ETF | YOLO | 0.74% | 2019 | VFF | IIPR | |

| AdvisorShares Vice ETF | ACT | 0.99% | 1.56% | 2017 | TMO | ABT |

| Amplify Seymour Cannabis ETF | CNBS | 0.75% | 2019 | GWPH | CGC | |

| Cambria Cannabis ETF | TOKE | 0.42% | 2019 | MEDIF | GWPH | |

| ETFMG Alternative Harvest ETF | MJ | 0.75% | 4.99% | 2015 | GWPH | CRON |

| Global X Cannabis ETF | POTX | 0.50% | 2019 | GWPH | APHA | |

| The Cannabis ETF | THCX | 0.70% | 2019 | MEDIF | GWPH |

Let’s hope your portfolio gets high with one of these ETFs.

Disclosure: Author didn’t own any of the above at the time the article was written.

by Fred Fuld III

You may have seen some of the major gains in some of the marijuana stocks and wanted to jump on the bandwagon. As an example, Cronos (CRON) has increased by 13% so far this year and Aurora (ACB) rose 26% even after experiencing a big drop during the last six months.

Maybe you are a relatively conservative investor and you want to receive a dividend in return for the risk you are taking. Fortunately, there are several cannabis stocks that provide investors with a yield.

Scotts Miracle-Gro Company (SMG) has a couple divisions in the marijuana industry. Its Hawthorne Gardening Co. subsidiary purchased General Hydroponics which makes and markets products for the pot growers. The company has also invested in the hydroponics company AeroGrow International (AERO) which markets to the small scale grower. Scotts’ current yield is 2.17%, with the latest dividend of 58 cents paid September 10 (today), an incense of 5.5% over the previous quarter. The dividend has increased on an annual basis since 2015.

AbbVie Inc. (ABBV), the marketer of Marinol also known as Dronabinol, a form of tetrahydrocannabinol, one of the main psychoactive ingredients of marijuana. The company has been paying quarterly dividends and has increased the annual dividend every year since 2013. AbbVie’s annual forward dividend yield is 6.28%. The company’s most recent dividend is $1.07 per share, which will be paid to investors on November 15, 2019 to shareholders of record on October 11.

Innovative Industrial Properties Inc. (IIPR), which trades on the New York Stock Exchange, owns, manages, and leases properties to state licensed cannabis growing facilities. Annual dividends since 2017 were 55 cents, $1.20, and $2.40. The dividends are paid quarterly, currently 60 cents per share, up from 45 cents for the previous quarter, an increase of 33%. The company pays a dividend yield of 2.79%.

Altria (MO) is the tobacco company that manufactures and markets cigarettes and smokeless tobacco. The company invested over a billion dollars in Cronos Group (CRON), the Canadian marijuana company. The stock has a forward yield of 7.9%.

Molson Coors (TAP) is the seventh largest brewer in the world. The company is in partnership with HEXO (HEXO) to produce cannabis-infused beverages in Canada. Molson Coors yields 4.03%.

Horizons Marijuana Life Sciences Index ETF (HMLSF) is an exchange traded fund that invests in many companies involved in the marijuana industry. It has a yield of 7.54%.

Constellation Brands (STZ), the beer, wine, and liquor producer, has a significant ownership in the Ontario, Canada based cannabis company Canopy Growth (CGC). Constellation has a dividend yield of 1.44%.

Let’s hope some of these stocks get high, and provide you with a smoking portfolio.

Don’t forget to read:

Exclusive Interview with Chet Billingsley CEO of Mentor Capital on the Marijuana Industry

Is Apple Getting into the Marijuana Industry?

Disclosure: Author owns CGC and a long option position in ACB.

by Fred Fuld III

Over 60% of states have legalized marijuana, either for medical purposes or for both medical and recreational use. In addition, Canada has legalized recreational cannabis throughout all the provinces after the passage of the Cannabis Act (also known as Bill C-45), joining Uruguay as the second country to do so nationwide.

If you want to invest in a new budding industry (no pun intended), it is generally considered a good idea to choose the largest stocks to invest in. They have greater liquidity, a larger following by analysts, and the large size is usually due to stronger earnings, stronger revenues, or at the very least, greater growth potential of revenues.

So if you are looking to place your investment dollars in the cannabis industry, you might want to start you due diligence with the largest companies by market cap. (market capitalization is the total number of shares times the current market price).

The biggest one by far is Canopy Growth Corp (CGC) with a market cap of $15.3 billion. The company has a big advantage in that Constellation Brands (STZ) invested a huge amount of money in the company, owning over a third of Canopy shares. Constellation known for its beer and wine, markets Pacifico and Corona beer, Robert Monday and Clos du Bois wine, and Svedka vodka. Canopy has a forward price to earnings ratio of 357 and trades at 2.87 times book value.

Coming in second place is Aurora Cannabis (ACB) with an $8.4 billion market cap. The stock has a forward P/E ratio of 555.5 and price to book value of 2.58.

GW Pharmaceuticals (GWPH) is a $5.64 billion company involved in developing cannabinoid biopharmaceutical products. It trades at 8.82 times book value.

Cronos Group (CRON) has a $5.13 billion market cap and produces and sells marijuana products in Canada, Germany, and other areas. The stock trades at 69 times forward earnings and 7.1 times book value.

Tilray (TLRY) has a $4.3 billion market cap. The company is developing cannabis infused beverages in partnership with Anheuser-Busch InBev (BUD). Tilray has a nosebleed-level forward P/E ratio of 1,111 and a price to book of 11.1.

Maybe one of these stocks will help your portfolio get higher and higher. Many tiny pot stocks are cropping up like weeds. Be careful with the smaller companies as they may go up in smoke and throw your portfolio out of joint. (Puns intended.)

Don’t forget to read:

Exclusive Interview with Chet Billingsley CEO of Mentor Capital on the Marijuana Industry

Is Apple Getting into the Marijuana Industry?

Disclosure: Author owns CGC.

by Fred Fuld III

During the last twelve months, there have been almost 500 initial public offerings of stocks. Some have crashed and burned, some are doing OK, and some are doing well.

However there are several of these IPOs that have done extremely well, more than doubling in price, with most being in the healthcare industry (and a couple in the marijuana category).

Here is the list of IPO stocks that fall into the price-double category:

by Nkem Iregbulem

Although marijuana can be used recreationally, medical marijuana has become increasingly popular over recent years as a growing amount of research supports its potential health benefits. Small studies show that medical marijuana may help in treating pain, nausea, loss of appetite, irritable bowel syndrome, Parkinson’s disease, epilepsy, and multiple sclerosis. D.C. and 31 states, including California, Nevada, Maine, Massachusetts, and Washington, have legalized medical marijuana. Meanwhile, the recreational use of marijuana is legal in 9 states, including California, Alaska, Oregon, and Colorado.

On June 21, the Canadian Senate passed the Cannabis Act, which regulates the production, distribution, and sale of marijuana in Canada. These plans have set off an investment boom or “green rush” in Canada as sales of certain forms of cannabis such as fresh or dried cannabis, cannabis oil, and plants and seeds for cultivation will now become legal. Canada will be the second country, after Uruguay, to legalize the sale of recreational marijuana.

This growing interest in marijuana may compel you to invest in pot stocks. If you are looking to gain exposure to the marijuana industry, you have a number of investment opportunities: AbbVie (ABBV), Aurora Cannabis (ACBFF), Canopy Growth (CGC), Constellation Brands (STZ), Cronos Group (CRON), GW Pharmaceuticals (GWPH), Scotts Miracle-Gro (SMG), and Tilray (TLRY). The ABBV, CGC, STZ, and SMG stocks are traded on the New York Stock Exchange, and ACBFF is traded in over-the-counter markets. Meanwhile, the CRON, GWPH, and TLRY stocks can all be found on the NASDAQ.

Your first option is AbbVie, a drug company that discovers, develops, manufactures, and sells pharmaceutical products worldwide. One of its products, Marinol, is a synthetic cannabis-based drug designed to not only helps chemotherapy patients with symptoms like nausea and vomiting but also help AIDS patients with their loss of appetite. The company was founded in 2012 and is headquartered in Illinois. AbbVie has a market cap of $144 billion and pays a dividend yield of 2.3%. The company’s stock trades at 23.67 times trailing earnings and at 10.74 times forward earnings. The stock has a price-to-book ratio of 42.01, and a price-to-sales ratio of 4.93, which would put it in the overpriced range. The company enjoys a three year revenue growth rate of 12.23% and a five year revenue growth rate of 8.95%. Its revenue has been increasing each fiscal year since 2013.

Aurora Cannabis, founded in 2006, is another option to consider. The company is based in Vancouver, Canada and is involved in the production and distribution of medical cannabis in Canada and internationally. The company’s product portfolio includes dried cannabis and cannabis oil. Aurora Cannabis has a market cap of $7.54 billion and does not pay a dividend. The company’s stock trades at 546.76 times trailing earnings and at 303.03 times forward earnings. The stock has a very high price-to-sales ratio of 97.68, so it is considered overpriced. The stock also has a price-to-book ratio of 7.59. The company’s revenue has been increasing since 2015, jumping from 1.44 million to 18.07 million and then to 55.2 million over the past few years.

Headquartered in Canada and founded in 2014, Canopy Growth is a licensed producer of medical marijuana. Its product portfolio includes items like dried flowers, oils and concentrates, softgel capsules, and hemp. Canopy Growth has a market cap of $10.8 billion and does not pay a dividend. The stock’s high price-to-sales ratio of 134.27 puts it well into the overpriced category. The stock also has a price-to-book ratio of 11.71. With its revenue increasing each fiscal year since 2014, Canopy Growth boasts a 3-year revenue growth rate of 266.47% and an even higher 5-year revenue growth rate of 724.53%. Most of the company’s revenue comes from its sales of medical marijuana under two of its brands, Tweed and Bedrocan.

Constellation Brands is a large alcoholic beverage supplier in the United States that produces beer, wine, and spirits. The company bought a large stake in the previous mentioned Canopy Growth. It is currently working on creating its own cannabis-infused non-alcoholic beverage. Constellation Brands has a market cap of $40.8 billion and pays a dividend yield of 1.39%. The stock trades at 22.04 times trailing earnings and at 21.83 times forward earnings. The stock has a high price-to-sales ratio of 5.5 and a price-to-book ratio of 3.82. With its revenue increasing each fiscal year since 2014, Constellation Brands enjoys a 3-year revenue growth rate of 7.96% and an even higher 5-year revenue growth rate 22.09%. Most of the company’s revenue come from its sales within the United States.

You might also consider Cronos Group, another cannabis company involved in the production and distribution of marijuana in countries such as Canada, Germany, and Australia. It sells dried cannabis and cannabis oils under its brand Peace Naturals. The company is headquartered in Toronto, Canada and was founded in 2012. Cronos Group has a market cap of $2.36 billion and does not pay a dividend yield. The stock trades at 917.86 times trailing earnings and at 129.87 times forward earnings. The stock has a price-to-book ratio of 10.68 and a very high price-to-sales ratio of 349.40. The company has seen increasing revenue values each fiscal year since 2015.

Based in the United Kingdom and founded in 1998, GW Pharmaceuticals is a biopharmaceutical company that researches and develops cannabinoid products for use in different disease areas. One of its products, Epidiolex, is derived from an active marijuana ingredient and is used to treat various rare childhood-onset epilepsy disorders. The company primarily does business in Canada, Europe, the United States, and Asia. GW Pharmaceuticals has a market cap of $4.78 billion and does not pay a dividend yield. The stock has a price-to-book ratio of 9.36 and a very high price-to-sales ratio of 245.76. The company’s revenue has been falling each fiscal year since 2014, giving the company a negative 3-year revenue growth rate of -35.03% and a negative 5-year revenue growth rate of -24.29%.

Another option is Scotts Miracle-Gro, the largest provider of gardening and lawn care products in the United States. Headquartered in Ohio and founded in 1868, the company sells most of its products to retailers such as Home Depot, Lowe’s, and Walmart. Over recent years, the company has taken steps towards growing its hydroponics business, one of these actions being its acquisition of hydroponic equipment maker, Sunlight Supply Inc. Medical cannabis can be grown through hydroponics, so this transition has given Scotts Miracle-Gro its association with cannabis. Scotts Miracle-Gro has a market cap of $4.34 billion and has a yield of 2.82%. The stock trades at 17.96 times trailing earnings and at 17.48 times forward earnings. The stock has a price-to-book ratio of 8.34 and a normal price-to-sales ratio of 1.73. The company has a 3-year revenue growth rate of 0.82% and a negative 5-year revenue growth rate of -0.94%.

Tilray is a pharmaceutical company that researches, develops and sells medical cannabis. The company was founded in 2018 and is based in Canada. The company’s product portfolio includes dried cannabis as well as cannabis extract in the form of purified oil drops and capsules. Most of the Tilray’s revenue comes from its sales within Canada, but the company also sells its products in Argentina, Australia, Chile, Germany, South Africa, and many other countries. Tilray has a market cap of $11.99 billion and does not pay a dividend. The stock trades at 2500 times forward earnings. Its stock has a price-to-book ratio of 414.61 and a very high price-to-sales ratio of 374.42.

The cannabis industry should continue to grow as more and more states continue to legalize, and as more and more of the large blue-chip marijuana companies jump in.