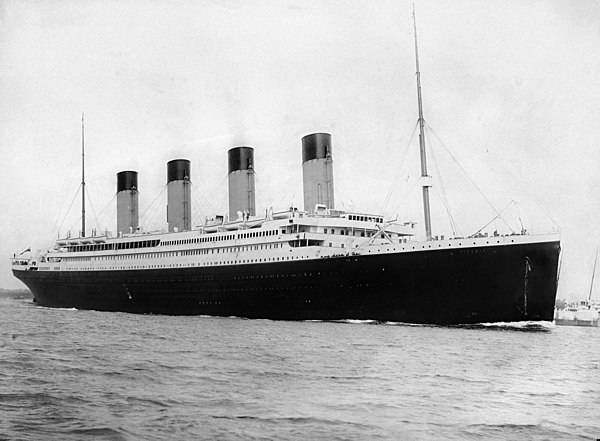

Investing in the stock market can be rewarding but challenging. Among the various sectors available, cruise line stocks have emerged as an intriguing option for many investors. With the world gradually recovering from the economic impacts of the pandemic, the cruise industry has been poised for a significant resurgence. Let’s dive into why cruise line stocks could be a smart addition to your investment portfolio.

Reasons to Invest in Cruise Line Stocks

1. Strong Rebound Potential

The cruise industry, like many others in the travel and tourism sector, was heavily impacted by the COVID-19 pandemic. However, as travel restrictions ease, the demand for cruising is expected to surge. Many cruise lines have reported a strong uptick in bookings for upcoming seasons. This rebound potential offers investors the opportunity to capitalize on the industry’s growth from its current undervalued state.

2. Diversified Revenue Streams

Cruise lines generate revenue from a variety of sources, including ticket sales, onboard spending, and excursions. This diversification helps mitigate risks associated with any single revenue stream. Cruise lines have been innovative in creating new revenue opportunities, such as premium dining experiences, exclusive shore excursions, and enhanced onboard entertainment options. This ability to diversify and innovate revenue streams positions cruise lines for sustained financial health and growth.

3. Strategic Cost Management and Expansion Plans

Many cruise lines have utilized the downtime during the pandemic to streamline operations and reduce costs. These cost-cutting measures, combined with strategic expansion plans, such as the introduction of new ships and itineraries, are set to enhance profitability as the industry recovers. Additionally, the industry’s focus on sustainability and adopting greener technologies could attract environmentally conscious investors, further boosting stock performance.

Listed below are the top four cruise line stocks:

- Norwegian Cruise Line Holdings Ltd. (NCLH) known for its premium brands—Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises—the company has built a loyal customer base that drives repeat business. Additionally, the company’s strategic initiatives, including cost management and the introduction of new, more efficient ships, are set to enhance profitability. These factors, combined with a focus on sustainability and innovation, make NCLH an attractive choice for investors looking to benefit from the anticipated resurgence in the travel and leisure sector.

- Carnival Corporation & plc (CCL) Known as the world’s largest cruise company, with a diverse portfolio of brands including Carnival Cruise Line, Princess Cruises, and Holland America Line. The company’s extensive global reach and strong brand recognition position it well to capitalize on the rebound in travel demand as pandemic restrictions ease. CCL has implemented significant cost-saving measures and has invested in new, more efficient ships. Additionally, its focus on sustainability and innovative customer experiences, and strategic growth initiatives, make CCL a strong candidate for investors seeking to benefit from the recovery and growth of the cruise industry.

- Royal Caribbean Group (RCL) is an attractive investment due to its status as a leading global cruise operator with renowned brands such as Royal Caribbean International, Celebrity Cruises, and Silversea Cruises. The company’s reputation for innovation, exemplified by its state-of-the-art ships and unique onboard experiences. RCL’s strategic initiatives, including cost efficiencies and fleet modernization with more sustainable and fuel-efficient vessels, positions itself with a strong financial outlook.

- Lindblad Expeditions Holdings, Inc. (LIND) has a niche focus on adventure and ecotourism, offering unique expedition experiences through its partnership with National Geographic. This strategic alignment allows LIND to cater to a growing market of environmentally conscious travelers seeking immersive and educational travel experiences. The company’s strong brand recognition and loyal customer base, combined with a fleet of specialized expedition ships, position it well to capitalize on the increasing demand for sustainable travel.

| Company | Company Symbol | Price to Book | PEG | PE | Price to Sales | Forward PE | Yield |

| Norwegian Cruise Line Holdings Ltd | NCLH | 20.49 | 0.54 | 26.49 | 0.83 | 9.38 | 0.00% |

| Carnival Corp. | CCL | 3.05 | NA | 62.53 | 0.9 | 11.05 | 0.00% |

| Royal Caribbean Cruises Ltd. | RCL | 7.55 | 0.66 | 19.81 | 2.64 | 11.82 | 2.02% |

| Lindblad Expeditions Holdings Inc | LIND | NA | NA | NA | 0.70 | NA | 0.00% |

The cruise line industry presents a compelling investment opportunity due to its strong rebound potential, diversified revenue streams, and strategic cost management and expansion plans. As the world returns to normalcy, cruise line stocks are well-positioned to deliver significant returns to savvy investors.

Disclosure: Author has a short position in RCL.

Stay ahead of the game and subscribe to our newsletter now to unlock the hottest investment opportunities!