by Fred Fuld III

3 minutes read time

Warren Buffett, often referred to as the “Oracle of Omaha,” has long been regarded as one of the most successful and astute investors in modern history. As the chairman and CEO of Berkshire Hathaway (BRK-A) (BRK-B), Buffett has built a reputation for making strategic, long-term investments that have paid off handsomely. His investment philosophy revolves around purchasing undervalued companies with strong fundamentals and holding onto them for the long haul.

Each year, investors eagerly await Buffett’s moves, as his decisions have the potential to signal broader market trends. In a surprising turn of events earlier this year, Buffett made new additions to Berkshire Hathaway’s vast portfolio by purchasing shares in two companies—Ulta Beauty (ULTA) and HEICO Corporation (HEI) (HEI-A).

Ulta Beauty, a leading retailer of cosmetics, skincare products, and salon services, is a particularly interesting choice for Buffett. Known for its wide selection of both high-end and mass-market beauty products, Ulta has managed to carve out a dominant space in the beauty industry. Despite the broader economic challenges affecting retail businesses, Ulta has continued to show resilience, driven by strong consumer demand for beauty products and an innovative omni-channel strategy that integrates online shopping with in-store experiences.

The company’s focus on customer loyalty through its popular rewards program has also helped to secure a dedicated customer base. For Buffett, a renowned value investor, the decision to invest in Ulta may reflect his confidence in the beauty industry’s growth potential and the company’s ability to withstand market fluctuations.

Ulta stock has a trailing and forward price to earnings ratio of 15. Although quarterly earnings per share tanked by 12% year-over-year, annual earnings are expected to grow by 7.9% next year. The return on equity is about 55%. The stock, with a market cap of $17.8 billion, does not pay a dividend.

HEICO Corporation, on the other hand, represents a different sector altogether. Specializing in aerospace and defense technology, HEICO is a leading producer of parts for aircraft, satellites, and defense equipment. The company has established a strong reputation for providing cost-effective and innovative solutions to the aerospace industry, an area of increasing importance given the ongoing global demand for air travel and advancements in space exploration.

HEICO’s unique position as a supplier to both commercial and military sectors makes it an appealing investment for long-term growth, particularly as governments and private companies alike invest in expanding their aerospace capabilities. For Berkshire Hathaway, HEICO fits the mold of a company with strong fundamentals and a clear path to future growth.

The stock has a trailing P/E of 76 and a forward P/E of 61, and pays a small dividend of 21 cents a share. This $36 billion market cap company sports earnings per share growth this year of over 25% with a growth rate next year of almost 17%. Sales growth jumped 43% year-ver-year. Return on equity is currently 14.8%.

Buffett’s investments in Ulta Beauty and HEICO Corporation are notable not just because of the companies themselves, but because they signal a broader strategy of diversification within Berkshire Hathaway’s portfolio. By investing in a beauty retailer and an aerospace company, Buffett appears to be hedging against risks in the broader economy, while also tapping into industries with significant growth potential. As always, Buffett’s moves have sparked considerable interest, with investors eager to see how these new additions will perform in the years to come. While only time will tell whether these investments will yield the same success as some of his previous picks, it’s clear that even at 93 years old, Warren Buffett remains as sharp as ever in identifying promising opportunities.

Disclosure: Author didn’t have any positions in any of the above stocks at the time the article was written.

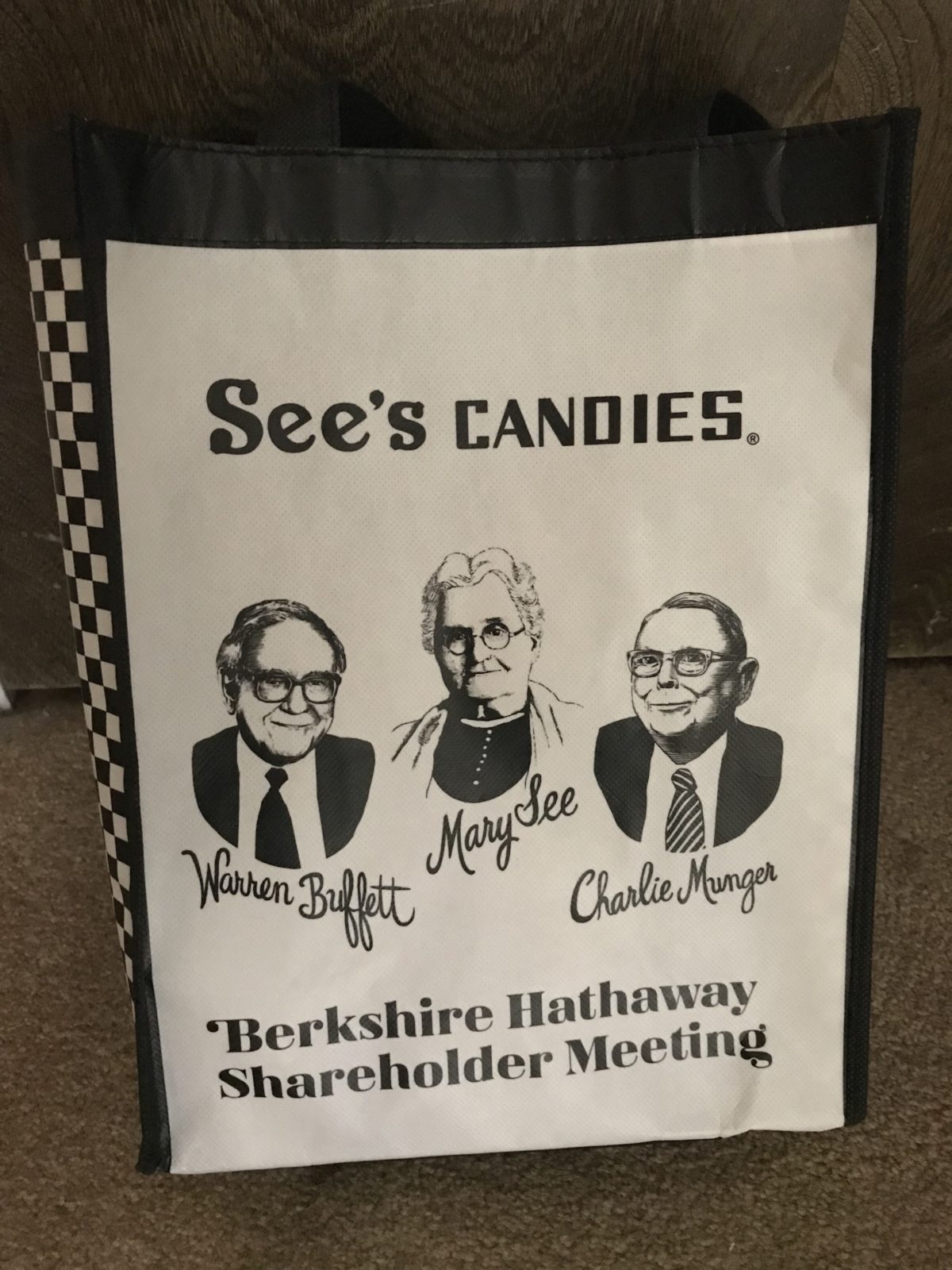

The event was held at the CHI Health Center Omaha Convention Center and Arena. The arena part of the center, which normally hosts basketball and hockey games, was where the meeting was held and the the convention center held the exhibiters of many of the companies that Berkshire Hathaway owns.

The event was held at the CHI Health Center Omaha Convention Center and Arena. The arena part of the center, which normally hosts basketball and hockey games, was where the meeting was held and the the convention center held the exhibiters of many of the companies that Berkshire Hathaway owns. Then on Saturday was the all-day annual meeting, starting with a movie about some of the products and services offered by Berkshire companies. After the movie was a question and answer session with Warren Buffett and Charlie Munger, which lasted all day long, other than a one hour lunch break. I don’t know how Warren and Charlie had the stamina. By two o’clock in the afternoon, I felt like taking a nap (but I didn’t).

Then on Saturday was the all-day annual meeting, starting with a movie about some of the products and services offered by Berkshire companies. After the movie was a question and answer session with Warren Buffett and Charlie Munger, which lasted all day long, other than a one hour lunch break. I don’t know how Warren and Charlie had the stamina. By two o’clock in the afternoon, I felt like taking a nap (but I didn’t).

Disclosure: Author owns BRKB.

Disclosure: Author owns BRKB.