by Fred Fuld III

ADRs (American Depositary Receipts) are financial instruments that allow U.S. investors to invest in foreign companies without needing to purchase shares on a foreign exchange. Essentially, an ADR represents a share (or multiple shares) in a foreign company but trades on U.S. exchanges like the NYSE or NASDAQ. Each ADR is issued by a U.S. bank and is backed by actual shares of the foreign company, which the bank holds in trust.

Advantages of ADRs:

- Easy Access to Foreign Stocks:

- ADRs provide U.S. investors with an easy way to invest in foreign companies without needing to navigate international stock markets, currencies, or regulations.

- Dollar-Denominated:

- ADRs are traded in U.S. dollars, so investors don’t have to worry about foreign exchange transactions or currency conversions when buying or selling shares.

- Liquidity and Simplicity:

- Since ADRs are traded on U.S. exchanges, they offer more liquidity and are easier to buy and sell than foreign shares listed on international exchanges.

- Regulatory Oversight:

- ADRs must comply with U.S. financial regulations, meaning the foreign companies issuing ADRs often provide financial disclosures in line with U.S. standards. This transparency can give investors more confidence.

- Dividends in U.S. Dollars:

- ADR holders receive dividends in U.S. dollars, which simplifies the process and eliminates concerns about currency fluctuations.

Disadvantages of ADRs:

- Currency Risk:

- Although ADRs are priced in dollars, their underlying shares are in foreign currencies. Therefore, changes in the foreign exchange rate between the U.S. dollar and the currency of the company’s home country can affect the value of the ADR.

- Fees:

- ADRs often come with additional fees, such as custodian or management fees, which can eat into returns. These fees are typically charged by the depositary bank.

- Limited Selection:

- Not all foreign companies offer ADRs, meaning investors have access to only a subset of international companies. If you’re interested in smaller or more obscure foreign stocks, ADRs may not be an option.

- Regulatory Differences:

- While ADRs are subject to U.S. regulations, the underlying companies are still foreign and may follow different accounting standards or face different political and economic risks compared to U.S. companies.

- Liquidity Risks (Depending on the ADR):

- Some ADRs, especially those representing smaller companies, can be less liquid than domestic stocks, making it harder to buy or sell at favorable prices.

In short, ADRs make it easier for U.S. investors to diversify their portfolios internationally, but they come with certain risks and costs that need to be considered.

New Fees:

Now lets talk about fees. I own many ADRs, which I’ve owned for years. Occasionally, I will get charged a foreign tax on a 1099-DIV, but I’ve never been charged a fee – that is, until now.

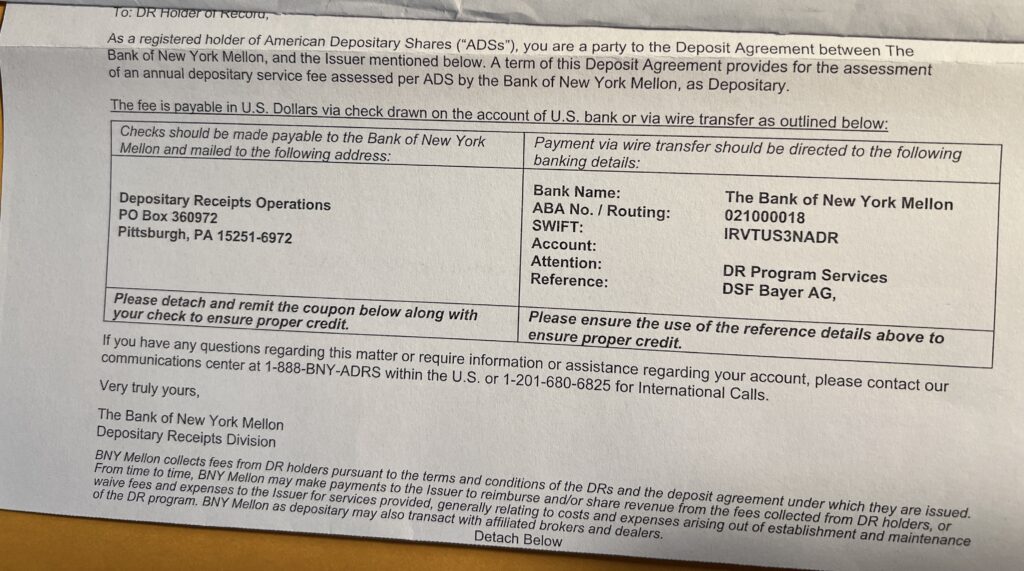

I recently received a bill from Bank of New York Mellon for an assessment of an annual depository service fee for one of my stocks that I own as an ADR, Bayer (BAYRY). The fee isn’t large but it’s a nuisance, and it is something I’ve never had to pay before, even though I’ve owned the stock for many years. BNY gives me the option of paying by check or wiring of the funds.

I called BNY to ask why I am being charged this fee when I haven’t been charged for it in the past, and the customer service rep said that previously the fee was deducted from my dividends. When I told her that dividends were paid on the stock this year (ex-dividend in April, payable in May), which provided more than enough to cover the fee, she checked into it and said that this was something new that the company (Bayer) implemented.

When asked what would happen if I didn’t pay the fee, I was told that a portion of my shareholdings would be sold to cover it.

My last question was if there were any other of my stocks that BNY is the depository for where a fee is now being assessed, and she said none of my other stocks that BNY is handling.

So when looking for ADRs to buy, especially if you are a large investor or an institution, beware of the depository service fee. Check with the stock’s transfer agent or depository agent.

Disclosure: Author owns BAYRY.