Berkshire Hathaway subsidiary’s bait and switch marketing tactics halted by regulator agreement

Insurance Commissioner secures numerous concessions from insurer to protect California businesses from high-risk, deregulated workers’ compensation product

SACRAMENTO, Calif. — After a year of legal wrangling, Insurance Commissioner Dave Jones announced today that the California Department of Insurance has reached a settlement agreement with Berkshire Hathaway subsidiaries to stop the bait and switch marketing tactics used to sell a workers’ compensation insurance product, which led to numerous complaints from employers caught up in the costly and complicated policies.

“This is a significant victory in protecting California businesses from sophisticated bait and switch marketing tactics,” said Insurance Commissioner Dave Jones. “We have gone to the limit of our authority over workers’ compensation insurance products in winning concessions that eliminate oppressive contract terms, such as the insurer requiring arbitration in the British Virgin Islands. The revised product terms include lower rates, improved disclosures, and limiting sale of the product only to companies that can absorb the substantial risks.”

In May 2016, in response to a complaint by a small business owner and after a hearing by an administrative law judge, the commissioner determined California Insurance Company and Applied Underwriters, both subsidiaries of Berkshire Hathaway, were selling a workers’ compensation product with illegal side agreements that modified the obligations of the parties under the policy.

Such agreements, known as Reinsurance Participation Agreements or RPAs, require department review and approval—the Berkshire companies used the agreements without first obtaining the department’s approval.

For example, the RPA did not disclose basic premium information, levied hefty penalties for policy cancellation, failed to disclose required binding arbitration outside the U.S., and obfuscated the methodology for calculating premiums, deposits, or other payments due.

Workers’ compensation insurance was partially deregulated by the legislature in the1990s—as a result, the insurance commissioner has only limited authority overrates and product features.

The department concluded Applied Underwriters was trying to avoid regulatory oversight, as noted in their U.S. patent application where the company described how its patent purports to evade regulatory oversight and ostensibly allows the company to sell a complicated type of policy to smaller businesses, which most states prohibit.

Even the revised products are not appropriate for businesses unable to adequately evaluate the pricing, obligations, and risks of such a complex product.

The department advises any employer considering such a complex product to consult an expert with legal and actuarial expertise in workers’ compensation products.

# # #

Media Notes:

Commissioner’s regulatory authority over workers’ compensation rates is limited to the following:

· The rates must be sufficient to make sure the companies remain solvent,

· The rates cannot tend to create a monopoly in the market, and

· They cannot be unfairly discriminatory.

Workers’ compensation insurers are required to file their policy forms with the department; however, the commissioner has very limited authority over product features.

This case is connected to the Shasta Linen case. Below is information on that case and the related issues:

· California Insurance Company (“CIC”), Applied Underwriters Captive Reinsurance Assurance Company (“AUCRA”) and Applied Underwriters (“AU”) are subsidiaries of Berkshire Hathaway. Both CIC and AUCRA are indirect subsidiaries of AU. CIC is a workers’ compensation insurer, and AUCRA is a workers’ compensation reinsurer for CIC. AU is not an insurer, but it offers insurance programs through affiliated insurance companies.

· Shasta Linen is a privately-held, family-owned California corporation in the linen rental business.

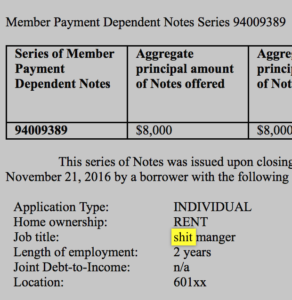

· Applied Underwriters promotes the EquityComp program as a loss-sensitive, profit-sharing plan. It consists of a guaranteed-cost workers’ compensation insurance policy issued by CIC and a “side” agreement, known as the Reinsurance Participation Agreement (“RPA”), that is sold as a profit-sharing plan issued by AUCRA.

· AU filed a U.S. patent application for the EquityComp Program, known as a “Reinsurance Participation Plan,” in which AU described its patent as a retrospective rating plan, which by law was required to be approved by the commissioner.

· In the Shasta Linen case, Shasta Linen challenged the validity of the EquityComp insurance program, including the unfiled RPA. CIC asserted that it was not required to file the RPA on the basis that it did not affect the underlying workers’ compensation insurance policy. An administrative law judge heard the case and issued a proposed decision against AUCRA and CIC. The commissioner adopted the decision and held that the RPA modified the underlying workers’ compensation insurance policy sold to Shasta Linen and it should have been filed as required by law. He also found that CIC and AUCRA unlawfully failed to file the rate associated with the RPA.

Shasta Linen – Issues:

· AU did not provide Shasta Linen with a copy of the RPA until after the inception of the program. Once provided, the RPA obfuscated key details by failing to disclose portions of the formulas it used to calculate rates and other costs.

· AU used its discretion to assess charges and retain large sums of money for indeterminate periods of time. There was inadequate transparency regarding AUCRA’s methodology for calculating amounts of premiums, deposits, and other payments due.

Benefits of Settlement

· The RPA was an unfiled product but the insurers conceded that it falls under the commissioner’s oversight and jurisdiction and has to be filed with the Department of Insurance.

· The settlement includes a dismissal of the writ petition filed by the insures in the Shasta Linen case, and the commissioner’s administrative decision in the Shasta Linen case will continue to stand as a precedent decision. This serves as a warning to other insurers that fail to file with the commissioner, for approval prior to use, any modifications to an employer’s workers’ compensation policy, and those that charge unfiled rates.

· The settlement includes new disclosures that will provide policyholders with key details regarding the product.

· The settlement effectively constitutes an acknowledgement that side agreements that modify the obligations of the parties to an insurance policy must be filed consistent with longstanding insurance law. This requirement was clarified in department regulations which went into effect on April 1, 2016, which included a provision that ancillary agreements, such as the RPA in this matter, must be filed and approved before they may be used by insurers.

· The settlement effectively constitutes an acknowledgement that rates and supplementary rate information must be filed with the department consistent with longstanding insurance law.