by Fred Fuld III

How would you like to own the following investment:

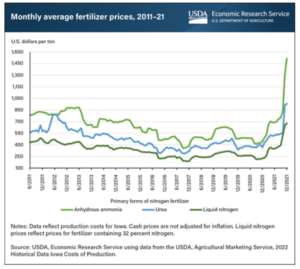

- It currently pays 9.62%

- It is backed by the United States Government

- It has an inflation factor

- There is no commission

- You can own it either electronically or in paper form

- The interest is exempt from state and local income taxes

- Interest earnings may be excluded from Federal income tax when used to finance education

- The investment never drops in price

- There is no minimum investment (well almost no minimum, you can invest less than $100)

So what kind of investment is this? No, it is not Forever Stamps. Sound too good to be true? It is called the Series I Savings Bond.

Here are the details.

What is an I Bond?

A Series I savings bond is a security issued by the United States Government that earns interest based on both a fixed rate and a rate that is set twice a year based on inflation. The bond earns interest until it reaches 30 years or you cash it, whichever comes first.

What’s the interest rate on an I Bond I buy today?

For the first six months you own it, the Series I bond is currently paying interest at an annual rate of 9.62%. A new rate will be set every six months based on the bond’s fixed rate and on inflation.

Special Benefits of Series I Bonds

You can own a bond in the name of a living trust. I know, because I’ve done it. It will be tied to you Social Security number.

For those that want to invest a lot of money in these bonds, they need to be aware that there is a $10,000 limit per calendar year per person. So a married couple could buy $20,000 now. Then next January, they could buy another $20,000, for a total of $40,000 in less than a nine month period.

In addition, there is another way they could buy more. An additional $5,000 per year can be invested in Series I bonds, using their tax refund. If you haven’t done your taxes yet (like me; I filed an extension, and yes, I’m still getting 1099s in late May), and you are expecting a refund of over $5,000, then $5,000 can be applied towards I bonds.

For next year, if you aren’t anticipating a big refund, you can always overpay your taxes by $5,000 so that you can get the maximum amount in Series I bonds for next year.

So assuming all things are in place, a married couple could theoretically invest $50,000 in I bonds in less than a year.

Who may own an I Bond?

| Individuals | Yes, if you have a Social Security Number and meet any one of these three conditions:

To buy and own an electronic I bond, you must first establish a TreasuryDirect account. |

| Children under 18 | Yes, if they meet one of the conditions above for individuals. Information concerning electronic and paper bonds:

|

| Trust, estate, corporation, partnership and some other entities | Electronic bonds (in TreasuryDirect): Yes Paper bonds:

|

How can I buy I Bonds?

Two options:

- Buy them in electronic form in our online program TreasuryDirect

- Buy them in paper form using your federal income tax refund

What determines who owns an I Bond and who can cash it?

How you register the bond at purchase determines who owns the bond and who can cash it. The registration is the name of the owner (either a person or entity), the Taxpayer Identification Number, and, if applicable, the second-named owner or beneficiary.

What do I Bonds cost?

You pay the face value of the bond. For example, you pay $50 for a $50 bond. (The bond increases in value as it earns interest.)

Electronic I bonds come in any amount to the penny for $25 or more. For example, you could buy a $50.23 bond.

Paper bonds are sold in five denominations; $50, $100, $200, $500, $1,000

How much in I Bonds can I buy for myself?

In a calendar year, you can acquire:

- up to $10,000 in electronic I bonds in TreasuryDirect

- up to $5,000 in paper I bonds using your federal income tax refund

Two points:

- The limits apply separately, meaning you could acquire up to $15,000 in I bonds in a calendar year

- Bonds you buy for yourself and bonds you receive as gifts or via transfers count toward the limit. Two exceptions:

- If a bond is transferred to you due to the death of the original owner, the amount doesn’t count toward your limit

- If you own a paper bond issued before 2008, you can convert it to an electronic bond in your account in TreasuryDirect regardless of the amount of the bond. (The annual limit before 2008 was greater than today’s limit of $10,000.)

Can I buy I Bonds as gifts for others?

Yes.

Electronic bonds: You can buy them as gifts for any TreasuryDirect account holder, including children.

Paper bonds: You can request bonds in the names of others and then, once the bonds are mailed to you, give the bonds as gifts.

How much in I Bonds can I buy as gifts?

The purchase amount of a gift bond counts toward the annual limit of the recipient, not the giver. So, in a calendar year, you can buy up to $10,000 in electronic bonds and up to $5,000 in paper bonds for each person you buy for.

Disadvantages

The disadvantages, although minimal are:

- The bonds are Federally taxable

- There is a maximum amount that you can buy

- Minimum term of ownership is one year

- Early redemption penalties if redeemed before 5 years, forfeit interest from the previous 3 months

So if you are looking to boost your yield on some of your cash, and getting more from a bank savings account, certificate of deposit, brokerage cash account, or treasury bond, you should seriously consider a Series I Bond.