by Nkem Iregbulem

As the third-wealthiest person in the world, Warren Buffett is widely regarded as an investment guru. His investment philosophy is based on the concept of value investing. He is the chairman, CEO, and largest shareholder of Berkshire Hathaway, the world’s 10th largest company by revenue. As of 2018, Buffett is estimated to be worth over $80 billion. He is not only an investor but also a dedicated philanthropist. In fact, he has promised to give 99% of his fortune to charitable causes.

Due to his success, Buffett’s stock purchases are closely followed by many other investors. Buffett’s Berkshire Hathaway recently purchased the stocks of JP Morgan Chase (JPM), Oracle (ORCL), PNC Financial Services Group (PNC), and Travelers Companies (TRV). His company also added to its position in Bank of America (BAC) and Apple (AAPL). These stocks can all be found on the New York Stock Exchange, except for AAPL, which is traded on the NASDAQ exchange.

With more than $2.5 trillion in assets, JP Morgan Chase is one of the largest financial institutions in the United States. The company is segmented into consumer and community banking, commercial banking, corporate and investment banking, and asset and wealth management. The company was founded in 1871 and is headquartered in New York, but it operates both within and outside of the United States. JP Morgan Chase has a market cap of $360.6B and pays a dividend yield of 2.89%. It trades at 13.70 times trailing earnings and at 11.07 times forward earnings. The stock has a price-to-sales ratio of 3.60, putting it into the overpriced range. It also has price-to-book ratio of 1.59. With its revenue growing each fiscal year since 2015, the company enjoys a 3-year revenue growth rate of 1.56% and a 5-year revenue growth rate of 0.53%.

Founded in 1977 and based in California, Oracle is a computer technology company that sells databases, middleware, applications, hardware, and other enterprise IT solutions. Most of the its revenue comes from software licenses, support, and maintenance, but the company has recently started to shift towards cloud-based subscriptions. Oracle has a market cap of $183.1B and pays a dividend yield of 1.57%. It trades at 49.21 times trailing earnings and at 14.33 times forward earnings. The stock has a price-to-sales ratio of 5.04, so it is considered overpriced. It also has a price-to-book ratio of 4.81. Oracle has a 3-year revenue growth rate of 1.38% and a 5-year revenue growth rate of 1.39% and has seen its revenue increase each fiscal year since 2016.

PNC is a financial services company involved in retail banking, corporate and institutional banking, residential mortgage banking, and asset management. With nearly 2,600 branches in 19 states and D.C., the company stands as the eight-largest bank in the United States — measured by assets. The company was founded in 1845 and is based in Pennsylvania. PNC Financial Services Group has a market cap of $61.4B and pays a dividend yield of 2.86%. The company’s stock trades at 11.17 times trailing earnings and at 11.56 times forward earnings.

It falls into the overpriced range with a price-to-sales ratio of 3.70. The stock also has a price-to-book ratio of 1.30. The company boasts a 3-year revenue growth rate of 2.03% and a 5-year revenue growth rate of 1.03%.

The Travelers Companies is an insurance company that was founded in 1853 and is headquartered in New York. The company segments its business into commercial and personal insurance lines. Under its commercial operations, it provides coverage for primarily midsize businesses. Under its personal line, the company mostly serves car and homeowners. The Travelers Companies has a market cap of $33.8B and pays a dividend yield of 2.40%. It trades at 14.33 times trailing earnings and at 11.26 times forward earnings. The company’s stock has a normal price-to-sales ratio of 1.17 and a price-to-book ratio of 1.51. The company enjoys a 3-year revenue growth rate of 2.08% and a slightly better 5-year revenue growth rate of 2.34% as its revenue has been increasing each fiscal year since 2015.

With over $2 trillion in assets, Bank of America is one of the largest and most well-known financial institutions in the United States. The company’s business operations can be segmented into consumer banking, global wealth and investment management, global markets, and global banking. Its lines of business include home mortgage lending, credit and debit cards, investment banking, brokerage services, small-business services, and many others. Headquartered in North Carolina and founded in 1998, Bank of America has a market cap of $267.5B and pays a dividend yield of 2.19%. The stock trades at 12.98 times trailing earnings and at 9.51 times forward earnings. It has a price-to-sales ratio of 3.20, so the stock falls into the overpriced category. It also has a price-to-book ratio of 1.12. The company has a 3-year revenue growth rate of 0.56% and a 5-year revenue growth rate of 1.46%. Its revenue has been increasing each fiscal year since 2015.

Apple is a large and familiar technology company that was founded in 1976 and is headquartered in California. It designs and sells computer software, online services, and consumer electronics. Its product line of electronics include smartphones, tablets, computers, and smartwatches. The company also provides services such as Apple Music, a music streaming service, and Apple Pay, a mobile payment service. Apple has a market cap of $741.37B and pays a dividend yield of 1.87%. The stock trades at 13.12 times trailing earnings and 11.96 times forward earnings. It has a price-to-sales ratio of 2.94, making it slightly overpriced. The company’s stock also has a price-to-book ratio of 6.92. With its revenue increasing each year over the past few years, the company boasts a 3-year revenue growth rate of 4.35% and an even higher 5-year revenue growth rate of 9.22%. Most of this revenue comes from Apple’s iPhone sales.

Hopefully, one of the richest men in the world can give you some profitable investment ideas.

Disclosure: Author didn’t own any of the above at the time the article was written.

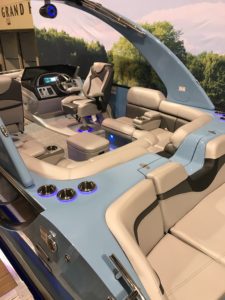

The event was held at the CHI Health Center Omaha Convention Center and Arena. The arena part of the center, which normally hosts basketball and hockey games, was where the meeting was held and the the convention center held the exhibiters of many of the companies that Berkshire Hathaway owns.

The event was held at the CHI Health Center Omaha Convention Center and Arena. The arena part of the center, which normally hosts basketball and hockey games, was where the meeting was held and the the convention center held the exhibiters of many of the companies that Berkshire Hathaway owns. Then on Saturday was the all-day annual meeting, starting with a movie about some of the products and services offered by Berkshire companies. After the movie was a question and answer session with Warren Buffett and Charlie Munger, which lasted all day long, other than a one hour lunch break. I don’t know how Warren and Charlie had the stamina. By two o’clock in the afternoon, I felt like taking a nap (but I didn’t).

Then on Saturday was the all-day annual meeting, starting with a movie about some of the products and services offered by Berkshire companies. After the movie was a question and answer session with Warren Buffett and Charlie Munger, which lasted all day long, other than a one hour lunch break. I don’t know how Warren and Charlie had the stamina. By two o’clock in the afternoon, I felt like taking a nap (but I didn’t).

Disclosure: Author owns BRKB.

Disclosure: Author owns BRKB.