by Fred Fuld III

Every month, I get many emails from authors, publicists, and publishers, asking if I would like to review their book. On some days, I get as many as two or three requests. Back in 2006, when I first started blogging, and received my first review request, I thought “Great, I get a free book.” Now, I’m just overwhelmed and I turn down a huge percentage of the requests.

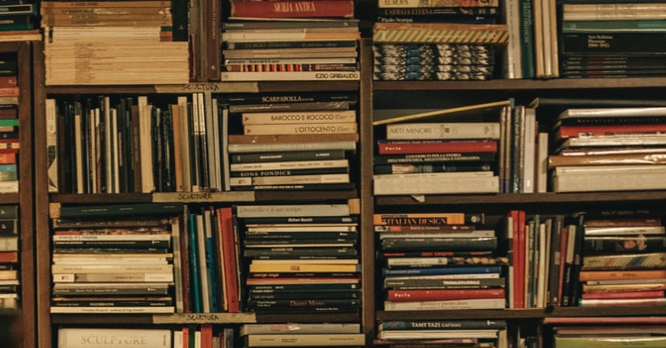

I have books stacked up all over the place. On my nightstand, I have three piles of books, each stacked up over two feet high. I have books on the floor next to my bed, the coffee table in the family room has three piles of books stacked up, and all the bookshelves are two rows of books deep with books stacked on top of the rows.

So besides lack of space, there are a lot of reasons why I might not review your book.

1. The book has nothing to do with business or investments

I’ve been asked to review all kinds of books, everything from cookbooks to children’s books. They may be great books but not a fit for Wall Street News Network.

2. The book is outside my area of expertise

Occasionally, I get a request to review an investment book that I have little knowledge of, for example commodities trading, which I feel I couldn’t give a fair evaluation due to my lack of familiarity.

3. The book is a blatant sales pitch

Many authors have a business or website that they are involved in, and they mention it in the book. I see no problem with this as I mention my web sites in a couple of my books. However, when a book puts at the end of each and every chapter, “Please call us at our 800 number to set up an appointment to discuss your financial situation,” then that is going way overboard. I actually received a book that did just that, so I didn’t even waste my time to review it. It’s too bad because the content of the book was pretty good.

4. The book is just too basic

I sometimes receive a book about finances and investing that is really simplistic. In other words, they include such recommendations as “Pay off your credit cards at the end of each month,” “Set aside some of your paycheck into an investing program,” etc. There is nothing wrong with this information, but the market for this type of advice is not the same audience that reads this blog.

5. The book is not my cup of tea

Every once in a while, I will read a book that I just don’t like. The book may not necessarily be bad, it’s just not for me, and it could be for one of many reasons. Others may really enjoy it. I just don’t want to write a bad review. As an author of a few books, I know the incredible time and energy that goes into writing a book. So instead of criticizing the book, I just won’t write anything, since I don’t want to deter another reader who may find the book to be just what they are looking for.

6. The book’s trading technique is too simplistic and not backed up with long term research

I received a stock trading book years ago, and it arrived a few months after the 2008 market crash. The book must have been published right around the peak of the the market. The technique could be boiled down to one sentence. Buy a good stock and sell it as soon as you have a slight profit. The rest of the book was filled with extraneous information about the stock market in general, which although somewhat interesting, did not relate to the trading technique. That wasn’t a major issue as many other books do that.

However, although a claim was made that the technique could be used in any market, the author used the results of a personal portfolio going back just two and a half years and ending just before the market crash. Looking at the current ‘holds’ in the portfolio at the end of the ‘study’ and comparing them to current stock prices at the time I finally read the book, it looked like the author would be holding most of those stocks for a long, long time (and it did take years for some to recover). A couple of the stocks went out of business, wiping out most of the trading profits that the author had made for the last couple of years.

I think that if an author claims that a trading technique can be used in any type of stock market, the research must be done over periods that include bear markets, and definitely longer than two and a half years ending at a market top.

7. I just don’t have the time

At this time, I have many books that I agreed to review, that I still need to get around to. Who knows when I will get through the list. So if I respond that I just don’t have the time to review it at this time, I mean it.

One other thing relating to Advanced Reader Copies.

I receive over 100 books a year for review, and since I don’t have the space to keep all of them, I gift, give away, and use as contest prizes the lightly-read books in conjunction with the blog.

Unfortunately, an Advanced Reader Copy or an Advance Uncorrected Proof is awkward to give away as a gift and really isn’t the real book. Often, they have missing page numbers in the Table of Contents and Index, many typos, and other errors and misinformation. .

Even my library system won’t accept a donation of ARC books.

Therefore, in order to cut down on the number of submissions and to receive a book that can be offered to my readers, I will no longer be accepting books if the review copy designation is printed on the cover or stamped in the book. Any such books will be discarded, unread, and unreviewed.

This policy is similar to other major reviewers such as Midwest Book Review.

Anyway, I’ve written many book reviews during the last few months, and hopefully you will find one of them interesting. And if you’ve written a book, maybe it will meet all my criteria and hopefully I will have time to read it.