Based on an article that originally appeared at Stockerblog.com on August 19, 2015

A domain name is, in simple terms, the address for a website. For example, Apple.com, Google.com, and Yahoo.com are all domain names. Domain names are often referred to as URLs (Uniform Resource Locators) or website addresses. Usually, it is what comes after the http:// or the https://, and sometimes you see a www thrown in there.

Some people actually register domain names as investments, which for the right name, can pay off handsomely. For example, whoever originally registered fb.com, eventually got lucky and sold out to Facebook (FB) for $8.5 million. The person who owned loans.com sold to Bank of America (BAC) for $3 million, with mortgage.com going to Citigroup (C) for $1.8 million. There are many other high priced domain sales that can be found in the Stock Market Trivia book.

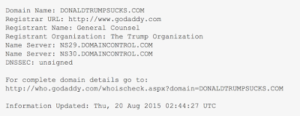

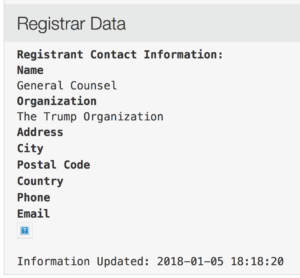

Donald Trump, the current president of the United States, owns the DonaldTrump.com domain of course. Well technically, the registration shows the ownership as the General Counsel of The Trump Organization, originally registered back on March 7, 1999. It is registered through GoDaddy (GDDY).

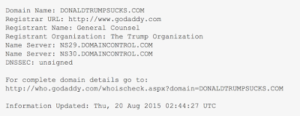

But when I checked out the owner of DonaldTrumpSucks.com back in 2015, I expected that it might have been registered by a Republican opponent of Donald Trump or possibly someone on the Democratic side. Yet it turns out that this domain is also owned by The Trump Organization.

When checking again today, it shows the same thing.

What is interesting is that this particular domain was registered on Christmas Eve, December 24, 2014. Was that the day that Trump really decided to run? This domain was registered through GoDaddy.

Trump’s company has registered over 3,000 domain names, and according to an article by the

International Business Times, the organization buys tens of thousands of domains every year.

Some of these purchases are for legitimate purchases, although currently the pages don’t appear to be live. For example:

trumpequities.com

donaldtrumpbriefcases.com

thetrumpexperience.com

trumpwatches.com

Trump isn’t buying all of them them for investment though. Apparently, many are purchased for guarding against “predators.” Here are some of the domains acquired by Trump:

trumpnetworkmarketingsucks.com

trumpnetworksucks.com

trumpcorporationsucks.com

trumporganizationsucks.com

trumpnetworkfraud.com

trumpnetworkponzischeme.com

All of the above point to a generic GoDaddy web page. However, it is interesting to note that if you go to TrumpSucks.com, it brings you to The Office of Hillary Rodham Clinton. The owner of TrumpSucks is unknown as it is privately registered through Domain Privacy Service.

The problem with acquiring the anti-Trump domain names is that there are thousands variances of domain names that people can come up with. One example, that I would rather not put in writing but begins with an F is owned by an individual who apparently has had it registered since 2004. For that matter, another domain, which has as its last part, a four letter word that begins with the letter S is also owned by an individual, and was registered a few years ago. Neither of these domains have developed web sites.

But even without the dirty words, there are other top level domains such as .net and .org that could be used with the anti-Trump words, As a matter of fact, an individual just registered donaldtrumpsucks.net in August 2015. And donaldtrumpsucks.org was registered exactly one month ago. Both with the registrar of, who else, GoDaddy, and neither of which are developed.

I’m not sure what the intent of these individuals are. Maybe they think they can resell their domains to the Trump Organization. Have fun dealing with the Trump lawyers.

But is there an investment angle to this, other than trying to find a good (bad) domain to resell to Trump? The one investment that sticks out is GoDaddy, due to its popularity as a domain registrar. Potential investors should be aware that the stock trades at nosebleed high price earnings and forward P/E ratios.

It will be interesting to see how the Trump domain activity plays out. If anyone has any ideas on an investment angle to the Trump domains, please post in the comment section below.

Disclosure: Author didn’t own any of the above at the time the article was written.

All valentines enjoy the gift of chocolate. The Rocky Mountain Chocolate Factory Inc. (RMCF), based in Durango, Colorado creates and sells various types of chocolate candy including caramels, creams, mints, and truffles. The company was founded in 1981, has over 300 franchise locations. The forward price to earnings ratio is 11.4. Rocky Mountain pays a very generous dividend yield of 4.38%.

All valentines enjoy the gift of chocolate. The Rocky Mountain Chocolate Factory Inc. (RMCF), based in Durango, Colorado creates and sells various types of chocolate candy including caramels, creams, mints, and truffles. The company was founded in 1981, has over 300 franchise locations. The forward price to earnings ratio is 11.4. Rocky Mountain pays a very generous dividend yield of 4.38%.

would make a nice gift (price is only $120,443). The stock trades at 23.8 times forward earnings. This stock also pays a dividend, with a decent yield of 1.89%.