by Fred Fuld III

I used to go to those “get rich quick” seminars every year or so as I wanted to see what the latest money making schemes were being foisted upon the American public, and they would give me some ideas for articles. I have a friend who was big fan of these events and was able to drag me along every once in a while.

Usually these conferences would last for a few hours and have three different presenters, each one lasting about an hour long, and at least one real estate related. So for one of the ones I attended, the first was how to flip houses, the second was trading with stock options, and the third, make money with tax liens.

The tax liens that were referred to in this event are county government liens against real estate where the property tax is past due. When the property owner fails to pay the taxes that are due, a tax lien certificate is issued. Investors can buy the tax lien certificates through auctions and can earn outrageously high interest rates of potentially 16%, 18%, 24%, or possibly 36% on their tax liens. The property owners are required to pay the back taxes plus the interest or they can lose their property to the tax lien owner.

The states that offer tax liens are as follows:

- Alabama

- Arizona

- Arkansas

- Colorado

- Florida

- Illinois

- Indiana

- Iowa

- Kentucky

- Maryland

- Mississippi

- Missouri

- Montana

- Nebraska

- New Jersey

- New York

- North Dakota

- Ohio

- Oklahoma

- Oregon

- South Carolina

- South Dakota

- Vermont

- West Virginia

- Wyoming.

- District of Columbia

Sorry, Californians. However, the good news is, you don’t have to live in a tax lien state in order to buy a tax lien in that particular state. You don’t even have to be a United States citizen or resident

So what was my story? After going to one of these seminars and being offered a course for a couple thousand dollars on how to buy tax liens, I thought to myself, why should I pay for a course? I will just go to the county website of a couple of counties that had tax lien auctions coming up and start bidding.

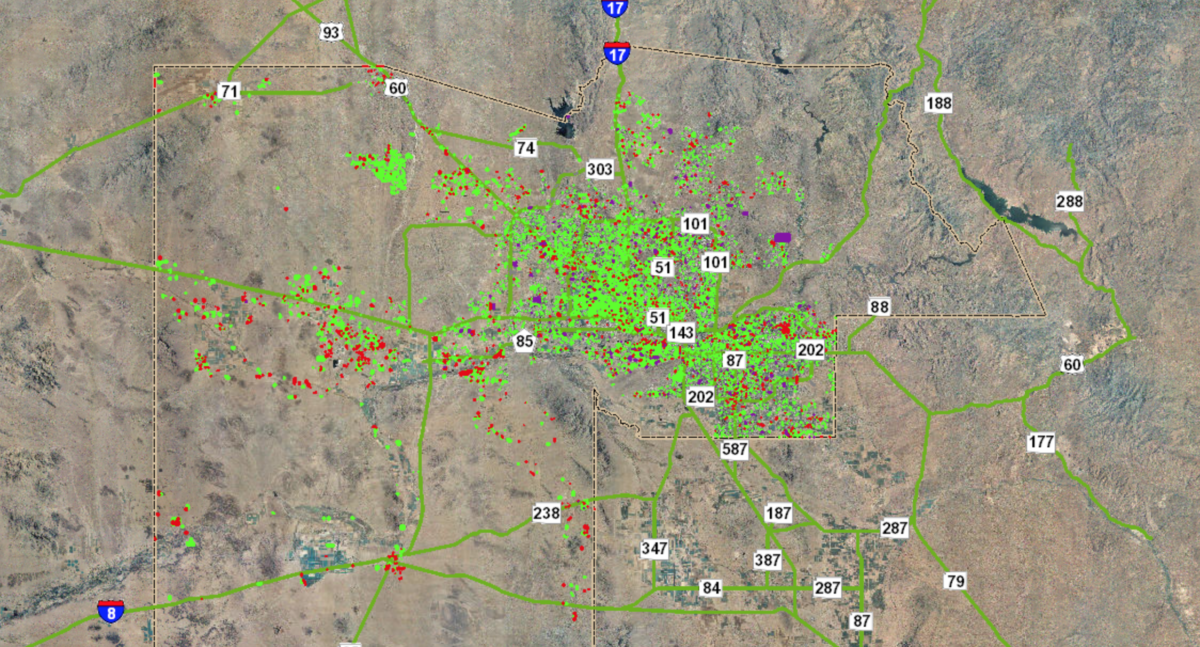

It was a little more difficult and time-consuming than that, but it worked. The fist thing I did, after discovering that Maricopa County in Arizona was having an auction, was that I began looking though the Tax Lien section of the Maricopa County Treasurer’s Office website.

I then accessed the list of all the tax liens of properties being auctioned off, and started going through it. After being overwhelmed with thousands of parcels, I decided to narrow it down, and chose the Scottsdale area. I figured that I couldn’t go wrong in a classy area.

So I went through every property in Scottsdale, houses, condos, lots, and raw land. It took a few hours but I did my searching while sitting in front of the TV with my laptop on a TV-dinner table, turning my wasted time into productive time.

I looked up literally every one of the properties on Google Maps. Some of the lots turned out to be strange shapes, like five feet wide by a hundred feet long. Some of the houses had liens that were way above my budget.

Then I came across a good one. It was a lot in an expensive neighborhood surrounded by million dollar homes, and the tax lien fit my budget of several thousand dollars. Since it was in a nice development, I figured that it wasn’t located on top of a toxic waste dump.

On Google Maps in Satellite View, I noticed that the ground had been graded and a space for a swimming pool had been dug, but no structure or even a foundation on the property.

But then I discovered something else. I found a map on the Maricopa web site (hard to find and navigate to at the time) which also had a satellite view. When I check on that map, it showed that the lot had a house on it! Apparently, the Google Maps picture was a bit out of date.

Well, that was a nice bonus. I registered to bid right away and funded my account.

Once all that was completed, I could bid. Now the way the bidding works may seem strange, but when you think about it, it makes sense.

Here is the bidding process. You bid on what interest rate you are willing to accept on your tax lien. The bidder who bids the lowest interest rate wins. At the time (this was several years ago), the bidding could range from 18% to 4% in one percent intervals, for this particular county. The bidding range has since changed; it’s now 16% down to 0%.

It was time for me to bid, with a couple weeks to go. I placed a bid of 6%, figuring that would be a nice return if I won.

Then two days before the auction close, I thought I better lower the bid to 5% as it would give me a better chance of winning, plus 5% is still a great return.

One day before the close of the auction, I changed my mind one more time. I wanted that property and I wanted it bad (badly?).

So I changed it to 4%, the lowest bid level available at the time. I really didn’t care by then how much or how little the interest rate was, I just wanted to get the tax lien and hope that it never got paid off, so I could take over ownership of the house.

The next day, the auction closed. According to the web site, there were two bidders at 4%, with me being one of them. What happens when there is a tie is a drawing takes place. I’m not sure how the drawing takes place but I won!

It was my lucky day. A few days later, I received the tax lien certificate in the mail. It looked nothing like any certificate I had ever seen. It appeared to have been printed with a dot matrix printer (are any of those still around?) and said something like “You are the owner of the following tax lien(s)”.

I still have a copy of it in a file in a box somewhere in my storage unit. If I ever find it, I will add the picture to this article.

Now you’re probably wondering. Did I get a million dollar mansion for a few thousand dollars?

As it turned out, I ended up owning the lien for a little over a month, but earning three months worth of interest. I’m not going to complain. I think it had something to do with the tax lien holding period overlapping three months.

The tax lien investment was practically risk-less. It was backed by the value of the property, which was substantial. Not to bad a return for such a short term holding in a very low interest rate environment.

There are plenty of these tax lien auctions available. As a matter of fact, there are 23 coming up in Florida in May. As a matter of fact, the City of Baltimore is holding a tax lien sale that has just started and ends in May.

If you are interested in learning more about tax liens, check out some of these books:

Zero Risk Real Estate: Creating Wealth Through Tax Liens and Tax Deeds

Profit by Investing in Real Estate Tax Liens: Earn Safe, Secured, and Fixed Returns Every Time

The Complete Guide to Investing in Real Estate Tax Liens & Deeds: How to Earn High Rates of Return

If you are looking for the web sites of the counties, parishes, and cities holding tax lien sales, here is a random sample of some of them with links:

Maricopa County, Arizona

https://treasurer.maricopa.gov/Pages/LoadPage?page=TaxSaleDetails

Yuma County, Arizona

http://www.yumacountyaz.gov/government/treasurer/tax-lien-information

Broward County, Florida

http://www.broward.org/RecordsTaxesTreasury/FrequentlyAskedQuestions/Pages/TaxCertificateSale.aspx

Sarasota County, Florida

https://www.sarasotataxcollector.com/services/tax-services/property-tax/tax-cert-sale

Sarasota RealTaxLien, Florida

https://sarasotafl.realtaxlien.com

Charleston County, South Carolina

https://www.charlestoncounty.org/departments/delinquent-tax/tax-sale.php

Gwinnett County, Georgia

https://gwinnetttaxcommissioner.publicaccessnow.com/PropertyTax/DelinquentTax/TaxLiensTaxSales.aspx

Fulton County, Georgia

https://www.fultoncountytaxes.org/property-taxes/property-tax-sales.aspx

Baldwin County, Alabama

http://baldwincountyal.gov/Government/revenue/divisions/collections/tax-sale

Lake County, Indiana

https://www.lakecountyin.org/portal/media-type/html/group/treasurer/page/default.psml/js_pane/P-13b9cba7958-10765;jsessionid=A16CFFBF59CB0D86B6F925D0A7CECBD4

Polk County, Iowa

https://www.polkcountyiowa.gov/treasurer/tax-sale-buyer-info/

Jefferson County, Kentucky

http://www.jeffersoncountyclerk.org/delinquenttaxes/

District of Columbia

https://otr.cfo.dc.gov/page/real-property-tax-sale

Baltimore, Maryland

https://www.bidbaltimore.com/main?unique_id=87A77E142A5211E8AB57310613945BAD&use_this=view_faqs

Nassau County, New York

https://www.nassaucountyny.gov/527/Annual-Tax-Lien-Sale

Happy Investing!!!