If you aren’t familiar with Sir John Templeton, he is the founder of the Templeton Growth Fund, a top performing international mutual fund. Money magazine called him “arguably the greatest global stock picker of the century.” His family of mutual funds was merged with Franklin Resources to become Franklin Templeton Funds.

Templeton was a billionaire and philanthropist who donated over a billion dollars to charitable causes. He also established the John Templeton Foundation and the Templeton Prize, which is given to a person who “has made an exceptional contribution to affirming life’s spiritual dimension, whether through insight, discovery, or practical works.”

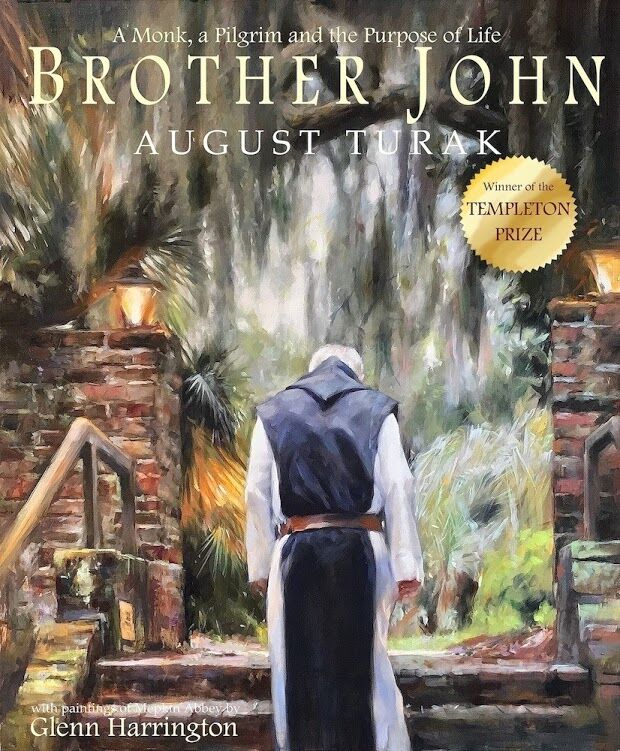

One of the winners of the prize is August Turak, author of the recently published book, Brother John: A Monk, a Pilgrim and the Purpose of Life. The book is about a man going through a mid-life crisis who meets an umbrella-wielding Trappist monk on Christmas Eve, and how it changes his life.

The book also includes over twenty pages of multi-color paintings by the award winning painter, Glenn Harrington.

Brother John is a well-written book about life, beautifully illustrated, and would make a great gift.