by Fred Fuld III

Many investors are interested in jumping on the Elon Musk bandwagon by investing in the companies he is involved with, other than Tesla (TSLA). With the success that Musk has been having with rockets and satellites, many investors see the growth potential in those areas.

Fortunately, there are a few ways to participate in the growth of those companies, even though they are not yet public.

Before I cover those ways, I want to relay a story to you about Apple (AAPL). Why Apple you may ask? Well let me explain.

Buying Apple Before It Went Public

Many, many years ago, before Apple went public, I was using an Apple II computer with the VisiCalc spreadsheet program to create financial planning worksheets. I couldn’t believe that calculations could be done so easily on a small machine and then printed out. I was working for an investment management firm at the time and wanted to invest in this little Apple Computer company. (That was the name of the company before it was changed to Apple Inc.)

Unfortunately, it wasn’t publicly traded. But fortunately, I read in a Forbes article that a publicly traded venture capital company called the Nautilus Fund, which was a closed end fund, had an equity interest in Apple. The fund held share of mostly public companies but also some shares of a few private companies. So to make a long story short, I bought some shares of the Nautilus Fund, Apple went public, and Apple shares were spun off to the Nautilus Fund shareholders. The rest is history.

Investing If Not Accredited

So you can see why investors, including myself, want to find some way to get access to Starlink and SpaceX shares.

If you are an accredited investor, you are probably aware of the services available to you for buying shares in private companies, and where there might be a minimum investment of $25,000. These services include Hiive, Forge, Microventures, and even NASDAQ Private Market.

An individual accredited investor is someone who has a net worth over $1 million, excluding primary residence (individually or with spouse or partner) and/or has an income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year. There is one other qualification that can allow you to meet the accredited requirement. If you are an investment professional with a Series 7, a Series 65, or a Series 82, then you may qualify. There are different rules for organization investors.

But if you are not an accredited investor, there are still ways for you to participate.

First, let’s discuss Starlink and SpaceX and their connection to each other.

SpaceX

Space Exploration Technologies Corp., commonly known as SpaceX, is a private aerospace manufacturer and space transportation company founded by entrepreneur Elon Musk in 2002. Musk established SpaceX with the ambitious goal of reducing space transportation costs to make space exploration and colonization more accessible, ultimately aspiring to enable human settlement on Mars.

Headquartered in Hawthorne, California, the company quickly gained attention for its innovative approach to rocket design and its focus on reusability, a concept that has transformed the aerospace industry.

SpaceX made history in 2008 when its Falcon 1 rocket became the first privately developed liquid-fueled rocket to reach orbit. This success was followed by a series of groundbreaking achievements, including the development of the Falcon 9 rocket, which features reusable first-stage boosters, and the Dragon spacecraft, capable of carrying cargo and crew to the International Space Station (ISS).

In 2012, Dragon became the first commercial spacecraft to dock with the ISS, marking a significant milestone in public-private partnerships in space exploration.

In 2020, SpaceX achieved another historic milestone with its Crew Dragon spacecraft, which carried NASA astronauts to the ISS as part of the Commercial Crew Program. This made SpaceX the first private company to launch humans into orbit.

Beyond crewed missions, the company has developed the Starship rocket, intended for deep-space missions and capable of transporting cargo and passengers to the Moon, Mars, and beyond.

SpaceX has also revolutionized global communications with its Starlink project, a satellite internet network designed to provide high-speed internet access worldwide. By combining technological innovation with a vision for humanity’s future in space, SpaceX continues to play a pivotal role in advancing aerospace technology and shaping the future of space exploration.

Starlink

Starlink Services, LLC, a subsidiary of SpaceX, was established to provide high-speed satellite internet to underserved and remote regions across the globe. Launched in 2015 as part of Elon Musk’s vision to create a global broadband network, Starlink operates a constellation of low Earth orbit (LEO) satellites that communicate with ground stations and user terminals to deliver high-speed internet access. Its mission aligns with SpaceX’s broader goals of advancing space exploration and connecting humanity, particularly in areas lacking reliable internet infrastructure.

Starlink officially began beta testing its services in October 2020 under the program “Better Than Nothing Beta,” offering Internet speeds between 50 Mbps and 150 Mbps. It quickly garnered attention for its ability to provide connectivity in rural and remote areas, where traditional cable or fiber infrastructure is often unavailable. The service expanded rapidly, reaching customers in over 50 countries by 2023. Starlink has since developed specialized products, including maritime and aviation solutions, to cater to various industries beyond residential consumers.

Known for its user-friendly hardware, Starlink employs a compact satellite dish and modem for easy setup. Its advancements in satellite technology have included innovations like phased-array antennas and laser inter-satellite links to improve latency and bandwidth.

By leveraging a network of thousands of satellites, Starlink aims to overcome the limitations of geostationary satellites, providing lower latency and more stable connections for applications like video conferencing, gaming, and remote work. As of recent reports, Starlink continues to grow its satellite constellation and improve its service capabilities, making it a key player in the global push for universal Internet access.

Ways to Invest

Alphabet (GOOG) (GOOGL), more commonly referred to as Google, has a division called Google Ventures, which invested in SpaceX almost ten years ago, giving it a reported 7.5% ownership of the company. However, Google is such a huge company that the value realized from the growth of SpaceX will have a very small effect on Google’s stock.

The same thing is true of Bank of America (BAC), which also invested in SpaceX almost seven years ago, in the amount of $250 million.

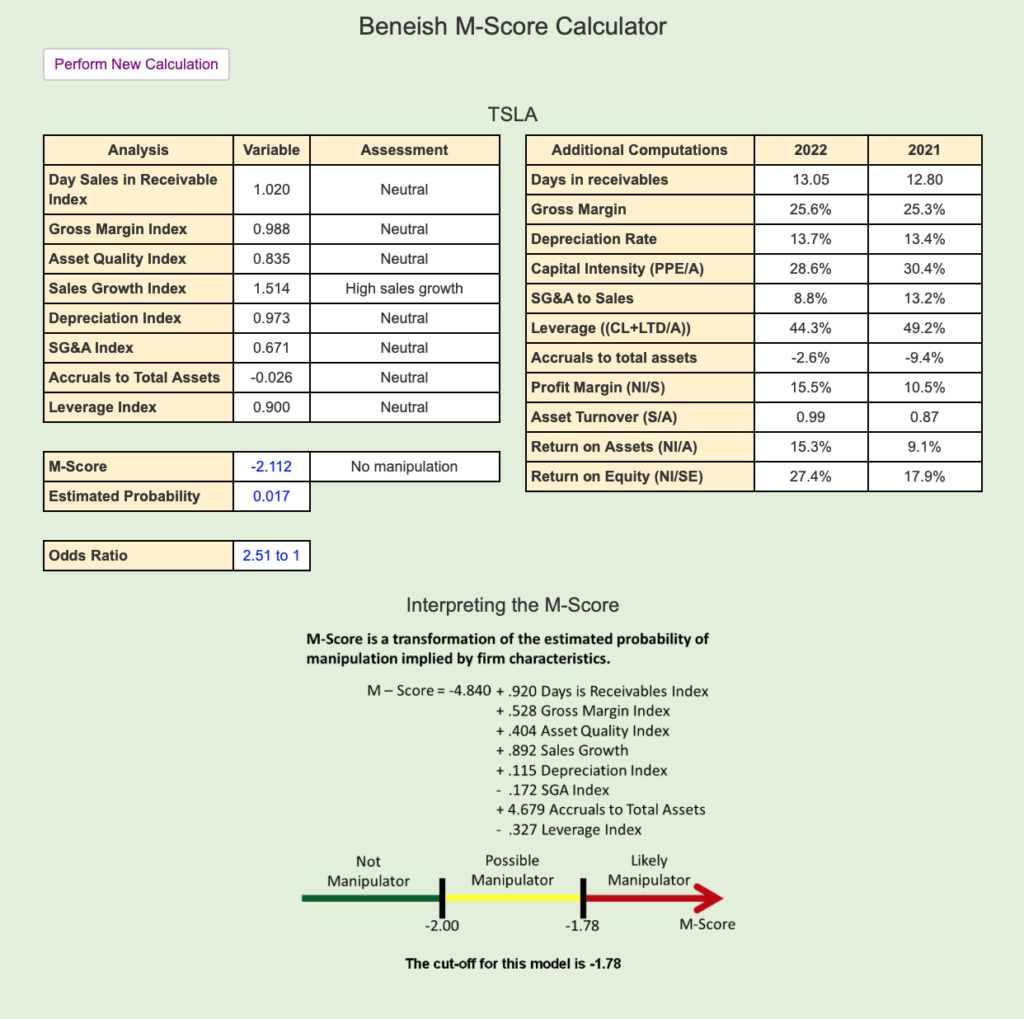

Some articles suggest investing in competitors of SpaceX, but be careful. Look what happened to all the new electric car competitors to Tesla (TSLA). Fortunately, there are some other alternative ways to jump on the SpaceX bandwagon.

There is a closed-end fund called ARK Venture Fund (ARKVX), which reportedly has over 10% of it’s assets in SpaceX, in addition to ownership of shares in a couple more Musk companies, X and xAI.

At the time this article was written, an individual investor would have to buy the stock through SoFi. As a matter of fact, for a limited time, SoFi is offering $25 worth of free stock including fractional shares if you sign up through THIS LINK. There are dozens of choices of free stock that you can choose from, even Berkshire Hathaway (BRK-B) and SoFi (SOFI).

According to the fund prospectus:

“Unlike an investor in many closed-end funds, Shareholders should not expect to be able to sell their Shares regardless of how the Fund performs. An investment in the Fund is considered illiquid.”

It also says, “Unlike many closed-end funds, the Shares are not listed on any securities exchange. The Fund intends to provide liquidity through quarterly offers to repurchase a limited amount of the Fund’s Shares (expected to be 5% of the Fund’s Shares outstanding per quarter).”

The fund has a management fee of 2.75%. The price of the fund has gone up by 27.26% over the last twelve months.

There is one other closed-end fund that owns SpaceX, called Destiny Tech100 Inc. (DXYZ),which trades on the New York Stock Exchange. It currently has 22 companies in its portfolio with SpaceX making up the largest share at 36.9%. Other stocks in the portfolio include Axiom Space, OpenAI, Instacart, Stripe, and Discord. The company has a management fee of 2.5%. In the last six months, the stock has gone up by 189%.

Any of the above ways will give you some participation in the growth of SpaceX or Starlink, but there is one more play in Starlink.

A company called KVH Industries (KVHI) is a Starlink authorized hardware and airtime reseller. This is a microcap stock with a market cap of $108 million, and is therefore extremely risky. The stock, which is currently generating negative earnings, has a favorable price to sales ratio of 0.91, and is selling for 76% of book value.

If you are considering investing in SpaceX or Starlink, even indirectly, you may think your portfolio will go to the moon (or Mars). Just be aware that there are extensive risks involved.

Disclosure: Author owns TSLA, KVHI, and DXYZ.